Won’t affect credit score

100% secure

Takes two minutes

Finding affordable car insurance doesn’t have to be complicated. You can compare quotes, switch providers anytime, and start saving in minutes. Whether you want full coverage or the cheapest car insurance in your state, switching is simple when you follow a few smart steps.

Good to know: You can switch car insurance at any time. Just make sure your new policy starts before cancelling the old one to avoid a coverage gap.

🔍 Compare in minutes

Shopping around can save you hundreds per year

💰 Cheap doesn’t mean less coverage

Smart choices can lower your rate without cutting protection

✅ Switch anytime

Cancellation fees and coverage gaps are avoidable with proper timing

📉 Lower your rate

Safe driving, bundling, or switching carriers can lower what you pay

📱 Fully online

Get quotes, compare, and buy your policy, all without a phone call

Once you enter your details, we match you with car insurance providers that fit your profile. You’ll see real quotes based on your location, driving history, and coverage needs, with no obligation to buy. We use secure technology to protect your information.

We don’t sell your personal data, and comparing quotes won’t affect your credit score. We partner with trusted insurance providers to help you compare options in one place.

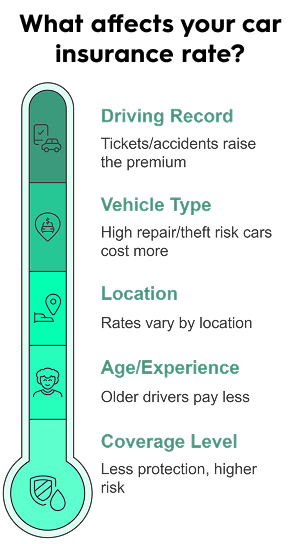

Insurance companies calculate your rate using a mix of factors:

Driving record: Tickets or accidents increase your rate.

Location: Costs vary by state, city, and even ZIP code.

Vehicle type: Cars with expensive parts or theft risk cost more to insure.

Age and experience: Younger or new drivers usually pay more.

Coverage level – More protection means a higher premium, but less risk for you

💡 Tip: Review your policy once a year. Even small changes, like mileage or address, can lower your rate.

If your premium has increased or your situation has changed, you might be paying more than necessary. Switching carriers lets you find cheaper car insurance without sacrificing coverage or service.

Many drivers save over $100 per year by switching.

There’s no penalty for comparing quotes or changing carriers mid-policy.

Online tools make it easy to estimate your new insurance cost in minutes.

events like moving, adding a driver, or improving your credit can unlock better rates.

Bottom line: Switching puts you back in control. You keep your protection, drop your price, and only pay for what truly fits your current needs.

Car insurance rates can vary significantly between providers for the exact same coverage. By comparing multiple insurers side-by-side, you can:

Find lower rates for the same coverage

Discover discounts you may qualify for

Avoid overpaying due to loyalty or inertia

When comparing car insurance quotes, it’s important to look beyond price alone. Here’s what to focus on:

Compare coverage, not just cost

Make sure the quotes include similar coverage limits and deductibles. A cheaper policy may offer less protection.

Review policy features

Some insurers include extras like accident forgiveness, roadside assistance, or deductible reductions.

Check the insurer’s reputation

Customer reviews and claims satisfaction matter — especially when you need to file a claim.

Consider bundling carefully

Bundling auto insurance with home or renters insurance can lead to discounts, but it’s not always the cheapest option.

Car insurance is required in most U.S. states and protects you financially if you cause or experience damage. The main coverage types are:

🔹 Liability: Covers injury and property damage to others if you’re at fault (required in most states).

🔹 Collision: Pays for damage to your car from an accident, regardless of fault.

🔹 Comprehensive: Covers non-collision issues like theft, vandalism, weather.

🔹 Uninsured/Underinsured motorist: Covers your medical expenses and vehicle repairs if the other driver lacks coverage.

🔹 Medical payments insurance (MedPay): Covers your medical costs, regardless of fault.

🔹 Personal injury protection (PIP): Optional broader medical coverage for you and your passengers, often including lost wages and other expenses, regardless of fault (mandatory in some no-fault states).

💡 Full coverage typically combines liability, collision, and comprehensive.

Minimum liability: Cheapest, best for older or low-value cars.

Full coverage: Ideal for newer, leased, or financed cars.

Add-ons: Extras like roadside assistance, rental reimbursement, or gap insurance provide added peace of mind.

If your car isn’t worth much, minimum coverage might be enough. If replacing it would be costly, full coverage is worth it.

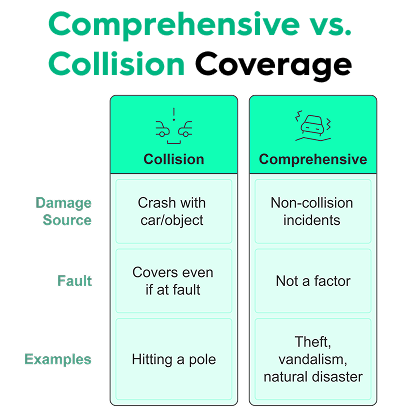

These two types of coverage protect your vehicle from different kinds of damage:

Collision covers damage from a crash with another car or object, even if it's your fault. Example: backing into a pole.

Comprehensive covers damages to your car from non-collision-related incidents. Examples include theft, vandalism, fire, natural disasters (like floods, hail, or falling objects), or hitting an animal.

Yes, you can switch whenever you want. Your insurer cannot stop you from cancelling or moving to a new provider. However, keep these points in mind:

Some insurers charge small cancellation fees.

You may qualify for a prorated refund on unused premiums.

Always start your new policy before cancelling your old one.

Even one day without coverage can raise future rates.

Switching usually takes less than 15 minutes once you’ve picked a new provider.

To get accurate car insurance quotes, you’ll be asked for a few basic details. Having these ready can make the process quicker and smoother.

Driver information

Date of birth

Driving history (recent accidents or violations)

License details

Vehicle information

Year, make, and model

VIN (if available)

Estimated annual mileage

Coverage preferences

Desired liability limits

Whether you want comprehensive or collision coverage

Don’t worry, comparing quotes won’t affect your credit score, and you’re not obligated to purchase a policy.

Looking to cut your rate? These proven strategies can help:

🏡 Bundle policies: Combine auto with home or renters insurance for a discount

📉 Raise your deductible: Pay less each month, but more out-of-pocket if you file a claim

🎓 Take a defensive driving course: Can earn discounts, especially for young or high-risk drivers

📱 Use telematics: Let your insurer track your driving via app or device for safe driver savings

🔄 Compare rates annually: Shop around at least once a year or when your life changes

We understand that every insurance provider offers unique policies and pricing. To simplify your search, we've partnered with a diverse network of top-rated car insurance companies, allowing you to easily compare multiple coverage and pricing options. This ensures you can confidently choose the policy that best fits your individual needs.

Our extensive network of top providers includes, but is not limited to:

Allstate

Geico

Progressive

Farmers Insurance

Gainsco

Liberty Mutual

The General

Nationwide

AAA

Amica

Root

USAA

State Farm

Bristol West

Costco

Mercury

Travelers

American Family

Freeway

Elephant

Experian

Direct Auto

Erie

Farm Bureau

Dairyland

Most drivers pay between a few hundred and a few thousand dollars per year, depending on their situation.

Your rate is based on factors like your age, driving history, location, vehicle type, coverage level, and credit history in some states. Because insurers weigh these factors differently, prices can vary a lot for the same driver.

The fastest way to lower your rate is to compare quotes from multiple insurers.

You can also save by raising your deductible, bundling policies, maintaining a clean driving record, asking about discounts, and removing coverage you no longer need. Even small changes can lead to meaningful savings over time.

In many cases, yes, but it depends on your policy.

If your policy includes comprehensive and collision coverage, it often extends to rental cars. Liability coverage usually carries over as well. However, coverage limits and exclusions vary, so it’s important to check your policy before declining the rental company’s insurance.

You can switch car insurance at any time, even before your policy ends.

Start by comparing quotes, choose a new policy, and set its start date before canceling your old one. Once the new coverage is active, contact your current insurer to cancel and avoid any lapse in coverage.

Yes, you can get non-owner car insurance if you don’t own a vehicle.

This type of policy provides liability coverage when you drive a borrowed or rented car. It’s commonly used by frequent renters, people who borrow cars often, or drivers who need insurance to maintain continuous coverage.

Yes. Your old insurer will still handle the existing claim while your new policy takes effect.

Even one day without insurance can raise future premiums or cause legal issues. Always overlap your policies.

Switching alone doesn’t automatically increase your premiums, but frequent cancellations, coverage gaps or multiple claims can, so keep a clean record.

At least once a year, or whenever you move, buy a new car, or add a driver.

Yes. Some providers specialize in coverage for high-risk drivers. Companies like The General, Bristol West, and Progressive offer options for drivers with past accidents, DUIs, or low credit scores.

If your state requires an SR-22, we’ll match you with providers who offer it. Companies like The General and Progressive often support this.

Usually, yes. Insurance follows the car, not the driver. So if you borrow someone’s car with permission, their policy typically covers you. But always double-check both policies to be sure.

Ensure safety: Move to a safe location and check for injuries.

Call the police: Report the accident to the police.

Exchange info: Collect names, contact details, and insurance information.

Document the scene: Take photos of the accident, vehicle damages, and any relevant details.

Notify your insurer: Report the accident as soon as possible.

Yes. You can compare quotes from multiple top-rated insurers without commitment or credit impact.

Yes, BestMoney is a trusted and reputable platform that helps users compare financial products, including car insurance. It partners with top-rated insurers to provide transparent and competitive offers.

Nope. There’s no obligation. You can view your offers, compare, and choose only if you're ready.

You don’t have to wait until renewal to find a better rate. With today’s online tools, switching car insurance is fast, secure, and can save you real money.

In short:

You can switch car insurance anytime.

Compare multiple quotes to find the best rate.

Avoid coverage gaps and check for cancellation fees.

🚗 Ready to save?

Answer a few quick questions, compare your offers, and start saving on car insurance today.

AI was used in the creation of this content, with human validation to ensure accuracy and clarity.