After getting a slight break on their auto insurance rates during the pandemic, drivers in the U.S. are now seeing rates escalate.

According to Bankrate.com, the average cost of car insurance in 2022 is $1,655 per year. The rising inflation rate and an increased number of accidents on the road are resulting in even higher rates in many states.

Filling out this short questionnaire at BestMoney.com and getting the best car insurers for you may save you hundreds of dollars with the same coverage. Fill in your ZIP code and Start Now >>>

How Do I Pay Less?

{geo-state} drivers are legally required to have their vehicles insured, but there are a few ways drivers can try to save money on their insurance.

The most significant way for drivers to save money on car insurance is to shop around for the best rates. Often, a consumer’s best chance to save big bucks on their insurance bill is to find a new provider using a comparison website, such as BestMoney.com, which provides you with the added advantage of lower prices and great deals.

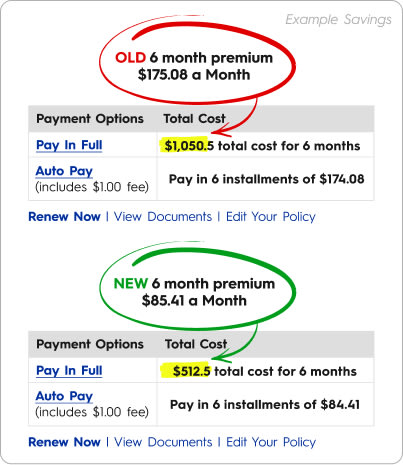

When drivers visit sites like BestMoney.com, they can view all the best rates in their area. Survey data indicates it is possible to save up to $820+ per year on your car insurance rates. Thousands of U.S. drivers have already trusted BestMoney.com to get significant discounts. Don’t let this opportunity pass you by!

Experts recommend getting at least three price quotes from providers before you buy new car insurance. Get yours for FREE from BestMoney.com >>>

Are you being overcharged by your insurance agent? Take two minutes out of your day to protect yourself from overpaying.

Note that your policy may be refundable if canceled. Therefore, you might be able to switch your insurance even before your coverage term ends, potentially saving you money.

Here's How You Do It

- Step 1: Simply select your age below and complete the quiz on the next page.

- Step 2: Fill out some basic information and review quotes from top companies.

https://fortune.com/2022/03/15/auto-insurance-rates-jump-20-percent-could-go-higher/

https://www.usnews.com/insurance/auto/low-mileage-car-insurance

https://www.metromile.com/blog/low-mileage-auto-insurance-discount/

https://quotewizard.com/auto-insurance/low-mileage-discount