This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which may impact the location and order in which brands (and/or their products) are presented, and may also impact the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

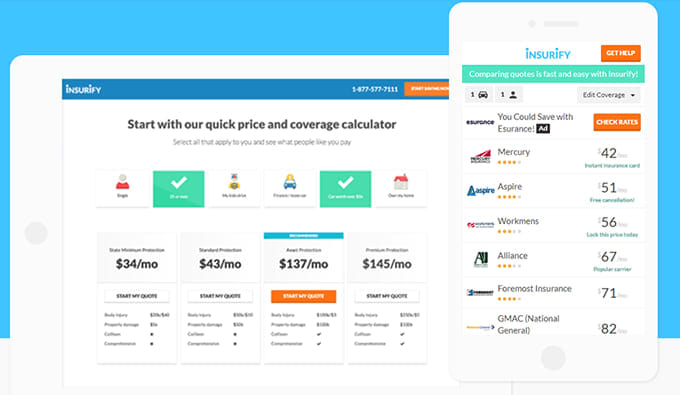

AI technology is Insurify’s special sauce, enabling it to give you instant rates and recommendations without any need for a phone call. Just plug in some basic details about yourself and your vehicle to get rates from more than 120 auto insurance companies. Or, for an even quicker comparison and personalized recommendations of the right type of insurance policy for your needs, just text a photo of your license plate to Insurify’s Personal Virtual Agent on Facebook Messenger. Either way, Insurify says it’s committed to getting you a quote within three minutes.

There aren’t any obvious downsides to Insurify’s service, given it’s free to use and requires only a few minutes of your time. With that said, this is a purely online search platform. Although Insurify does maintain a customer support line during operating hours, it’s obviously ideal for people who are comfortable entering personal information online.

Insurify has won multiple awards for its product, including the 2016 ACORD Insurance Innovation Challenge Startup Disruptor – which it won for using AI and natural language processing to simplify the car insurance shopping experience.

Insurify isn’t a direct insurance provider, but rather acts as an intermediary to more than 120 leading auto insurance companies from around the United States. Insurify gives personal recommendations on the right type of insurance for your needs, based on your location, personal profile, and driving history. Coverage could include:

Liability (Bodily Injury and Property Damage). Covers liabilities when you’re the at-fault driver.

Collision. Covers replacement or repairs if your vehicle is damaged in a collision with another vehicle or object.

Comprehensive. Covers replacement or repairs if your vehicle is damaged in a non-collision incident such as a fire, flood, vandalism, or theft.

Uninsured and Underinsured Motorist. Ensures you’re not left paying for the other driver’s liabilities if they don’t have a sufficient level of insurance.

Personal Injury Protection or Medical Payments. This type of coverage varies from state to state, covering hospital visits and related expenses such as rehab and lost income if you or your passengers are injured in an accident.

Add-ons. Most of the car insurance companies in Insurify’s network offer add-ons, such as rental coverage, emergency roadside assistance, equipment coverage, and ride-sharing coverage.

Discounts and Rewards. Insurify checks to see if you qualify for any driver discounts before transferring you to your chosen provider to complete your insurance purchase.

Insurify isn’t a direct insurance provider, but rather acts as an intermediary to more than 120 leading auto insurance companies from around the United States. Insurify gives personal recommendations on the right type of insurance for your needs, based on your location, personal profile, and driving history. Coverage could include:

To see a full rates comparison between multiple auto insurers, click the “Start saving now” button at the top of the Insurify home page. Enter information about yourself and other policy holders, and about the vehicle or vehicles being insured. After completing the online form, you’ll see a list of several auto insurance companies with good prices. Choose your preferred policy to complete the process directly with the insurer.

For an even quicker service, you can use Insurify’s Facebook Messenger service to speak to a virtual agent and find theinsurer for your needs. The virtual agent will ask you a couple of questions, such as whether you’re married or single. The agent will then ask you to upload a picture of your license plate and use that information to load up additional information about you and your vehicle. They’ll then show you the right car insurance company for you, and leave you with the option of calling an agent instantly with click-to-dial or having them call you back to complete the process. Insurify agents work with you to make sure you qualify for all possible discounts before transferring you over to your chosen provider.

As with other car insurance shopping platforms, Insurify doesn’t charge you a cent for its services. Your only payment is to your chosen insurer – and the insurer pays Insurify for referring you.

Because Insurify is an intermediary and not a direct underwriter of insurance products, all claims must be filed with the company you choose for your insurance coverage. The companies in Insurify’s network of car insurance companies typically let customers file claims using ore or more of the following:

Although Insurify is an online platform staffed by virtual assistants, it also provides human assistance via the following channels

Insurify is indicative of the future of car insurance, using its AI-powered virtual assistant to help motorists get low rates and personalized recommendations in minutes. If you’re looking to conduct a quick rates comparison and find the right policies for your needs from more than 120 leading car insurance platforms, Insurify is the right platform for you.