5,071 people

used BestMoney to find a lender last week.

Editor's Picks

Need help finding the right lender for you?

How much debt do you have?

What is a Debt Consolidation Loan?

Debt consolidation occurs when you combine multiple high-interest debts into a single monthly payment. This approach is commonly used to simplify repayment, reduce the number of due dates you manage, and make debt easier to track. In many cases, debt consolidation is achieved through a new loan with a fixed repayment term, though other methods may be used depending on your financial situation.

What Is Debt Relief?

Debt relief is an umbrella term for services that help borrowers manage or reduce unsecured debt when repayment has become difficult. Rather than replacing existing balances with a new loan, debt relief programs typically work with creditors to adjust repayment terms, lower interest rates, or, in some cases, reduce the total amount owed. These programs are commonly used by borrowers who may not qualify for traditional debt consolidation loans or who are experiencing financial hardship.

Debt Consolidation vs. Debt Relief: A Quick Distinction

While debt consolidation simplifies repayment by combining multiple debts into a single loan that is repaid in full, debt relief takes a different approach by modifying how existing debts are handled. Because these strategies serve different borrower needs, some companies featured in our comparison chart offer debt relief services alongside—or instead of—debt consolidation loans. Understanding this distinction helps ensure you’re comparing options that align with your financial situation.

| Industry leader for resolving large unsecured debts |

What Is a Debt Consolidation Loan?

A debt consolidation loan is a personal loan used to pay off balances owed to multiple creditors, such as credit cards and other unsecured debts. Once those balances are paid off, you’re left with one loan, one interest rate, and one monthly payment over a fixed repayment period.

These loans are typically offered by banks, credit unions, and online lenders. Depending on the lender, funds may be sent directly to your creditors or deposited into your bank account so you can repay the debts yourself. Debt consolidation loans generally work best for borrowers with steady income and sufficient credit to qualify for a competitive interest rate.

When used responsibly, a debt consolidation loan can simplify repayment, lower overall interest costs, and potentially help improve your credit over time by making on-time payments more manageable.

What Are APRs?

APR, or annual percentage rate, represents the total yearly cost of borrowing. It includes both the interest rate and any lender fees, such as origination fees, giving you a more accurate picture of what a loan will cost over time.

APR is one of the most important factors to consider when comparing debt consolidation loans. While interest rates show the cost of borrowing alone, APR accounts for additional charges, making it a more reliable comparison tool.

In general, the lower the APR, the less you’ll pay over the life of the loan.

Interest Rate vs. APR

- Interest rate: The percentage a lender charges for borrowing the loan amount

- APR: The interest rate plus any lender fees, expressed as a yearly cost

Because APR reflects the full cost of borrowing, it provides a clearer comparison between loan offers that may otherwise appear similar.

Typical APR Ranges and Disclosures

APR calculations vary by lender but are generally lower than those associated with payday or short-term loans. APRs typically range from 3% to 35.99%, depending on your credit profile, loan amount, and repayment term.

APR rates mentioned include associated fees.

The displayed loan repayment terms range from 61 days to 180 months.

Representative example:

A $10,000 loan over 60 months at a fixed interest rate of 3.1% per annum with $60 in fees would result in a 3.3% APR, monthly payments of $180.80, and a total amount paid of $10,868.00.

Key Insights

- Debt consolidation simplifies repayment by combining multiple debts into a single monthly payment, most commonly through a debt consolidation loan with a fixed term and payoff date.

- A lower APR is essential—consolidation is only effective if the new loan meaningfully reduces interest costs after fees such as origination charges are considered.

- Debt consolidation can affect your credit score both short-term and long-term, with potential temporary dips from credit inquiries and possible improvements from lower utilization and on-time payments.

- Not all borrowers qualify for the same options; credit score, income, debt-to-income ratio, and the types of debt you carry all influence eligibility and loan terms.

- Debt consolidation is not a standalone solution—success depends on avoiding new debt, maintaining disciplined repayment, and comparing alternatives such as balance transfers, credit counseling, or debt management plans.

How Does Debt Consolidation Work?

Debt consolidation works by using a new loan to pay off multiple existing debts—such as credit cards, personal loans, or student loans—leaving you with one loan to repay over a fixed period.

Once approved, repayment typically happens in one of two ways:

- Direct payment to creditors: The lender sends funds directly to your creditors, reducing the risk of missed payments and ensuring balances are paid off promptly.

- Cash deposited into your account: Funds are deposited into your bank account, and you’re responsible for paying off existing debts yourself. This option offers more flexibility but requires discipline.

After consolidation, you manage one loan with fixed monthly payments, a set repayment schedule, and a single lender.

Debt Consolidation Example

Here’s how debt consolidation can work in practice.

You have the following debts:

- Credit card A: $5,000 at 22% APR

- Credit card B: $3,000 at 19% APR

- Personal loan: $2,000 at 15% APR

Instead of making three separate monthly payments, you take out a $10,000 debt consolidation loan at a lower APR with a fixed repayment term. The new loan pays off all three balances, leaving you with a single payment and interest rate.

In a more complex scenario, you might owe:

- Three credit cards totaling $3,000

- Student loans totaling $55,000

- A private loan of $15,000

That’s $73,000 across multiple lenders, each with different payment requirements. By consolidating these debts into a single loan, you replace multiple monthly payments with a single payment to a single lender.

This simplifies repayment by:

- Reducing the number of payments you must track

- Making budgeting easier with one balance, one due date, and one interest rate

In many cases, consolidation may also lower total interest costs if the new loan has a lower rate, provided you avoid taking on new debt after consolidating.

Note: These examples are for illustrative purposes only and are not financial advice. Consider speaking with a qualified financial professional before making decisions about debt consolidation.

Debt Consolidation Options Explained

Debt Consolidation Loans

Debt consolidation loans restructure existing debt into a single loan while keeping balances intact. You repay the full amount owed, often at a lower interest rate, and your credit may improve over time with consistent payments.

What Are Debt Relief Programs?

Debt relief programs, also known as debt settlement or debt management programs, are structured services offered by third-party organizations that help borrowers manage or reduce debt without taking out a new loan.

- Debt settlement programs negotiate with creditors to reduce balances owed.

- Debt management plans (DMPs) reorganize payments and may reduce interest rates, typically through nonprofit credit counseling agencies.

These options are often used by borrowers who are struggling to make minimum payments but may involve fees and potentially affect their credit score.

Expert Tip: Debt Settlement Risks & Rewards

“Debt settlement companies talk to creditors to lower what you owe, resulting in some of your debt being forgiven. This can significantly reduce your total debt, but it also carries risks. It can hurt your credit score, and there’s no assurance creditors will consider such settlements.”

Debt Consolidation Loan vs. Debt Relief Programs

Debt consolidation loans reorganize debt into a single loan, while debt relief programs aim to modify or reduce debt balances. Consolidation typically preserves credit standing if payments are made on time, whereas debt relief may involve missed payments, longer timelines, and negative credit reporting during negotiations.

Other Debt Consolidation and Repayment Options

Some borrowers consider alternative approaches, including:

- Balance transfer credit cards: Introductory 0% APR offers, often requiring good credit

- Home equity loans or HELOCs: Lower rates but secured by your home

- Personal loans: May function as consolidation loans, depending on terms

- Using savings or retirement funds: Can eliminate debt quickly, but carries tax penalties and long-term financial risk

Each option has trade-offs. Choosing the right path requires balancing short-term relief with long-term financial impact.

When Is Debt Consolidation a Good Idea?

When you are struggling to pay multiple debts, each with its own due date and interest rate, taking out a debt consolidation loan can help reduce what you pay in interest and make repayment easier to manage. By combining your balances into a single monthly payment, you may be able to pay off your debts sooner and with fewer missed payments.

However, debt consolidation only works if it’s paired with a change in spending habits. If you continue using credit cards or taking on new debt after consolidating, you may end up in a worse financial position than before. If you’re not prepared to adjust your budgeting, spending, or borrowing behavior, debt consolidation may not be the right solution—and it may be better to walk away and explore other options first.

Expert Tip: Debt Consolidation Trade-Offs

“It’s a good move in certain circumstances. The most important thing to consider is the total amount of payments required to eradicate the debt. Sometimes when you consolidate, it will cost you a lot more over time, but if your immediate need is because you can't put food on the table, then you have to balance your goals.”

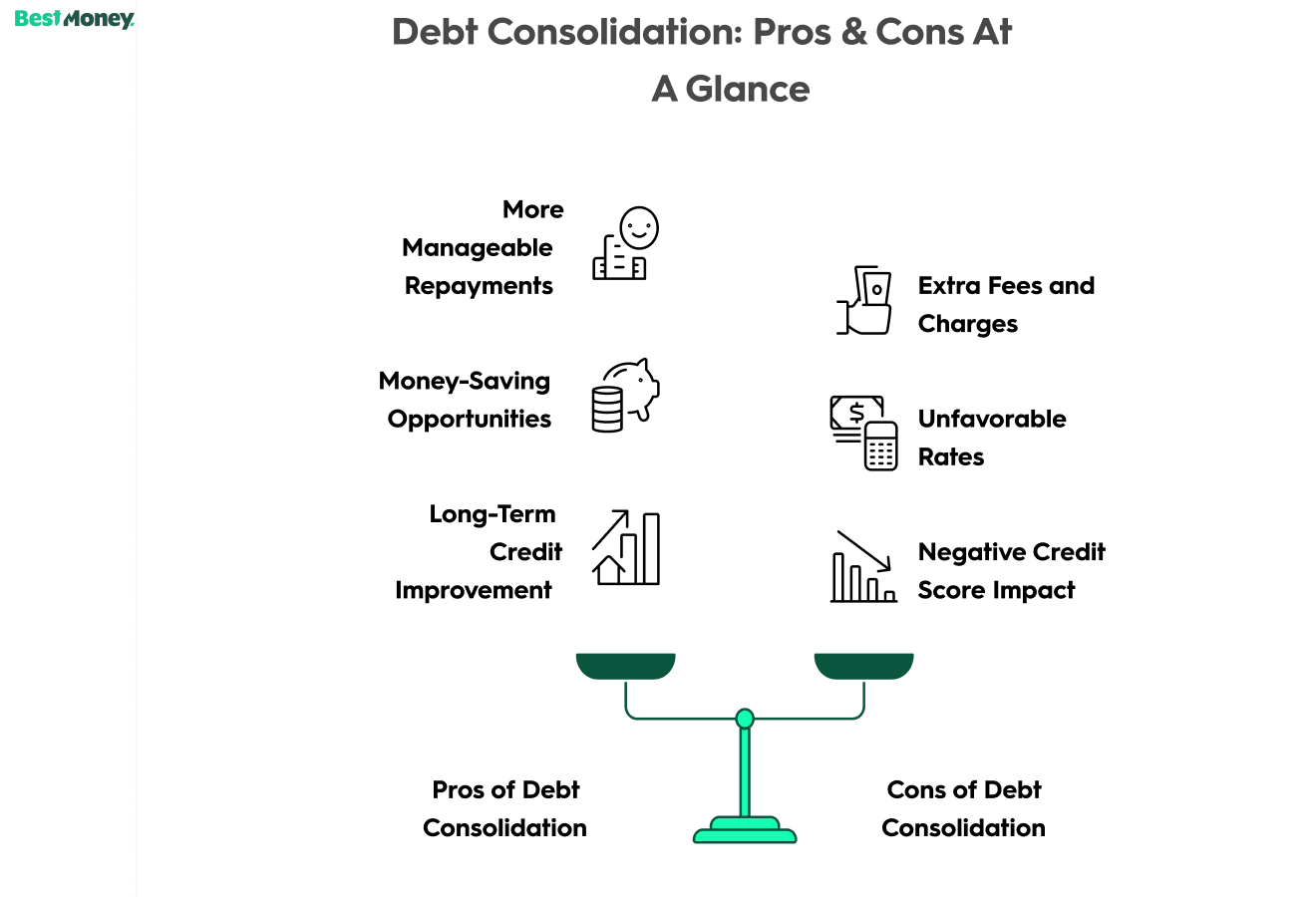

Pros and Cons of Debt Consolidation

Pros

- More manageable repayments: In lieu of tracking and making multiple monthly payments across balances, debt consolidation allows you to make one payment each month to a single entity.

- Money-saving opportunities: Debt consolidation loans potentially save you on interest, while debt settlement can lower the total amount of debt you owe.

- Long-term positive impact on your credit score: While debt settlement in particular can hurt your credit score in the short run, getting out of debt and enabling healthier financial habits should improve your creditworthiness in the long run.

Cons

- Extra fee or charges: Debt relief companies charge settlement fees, while debt consolidation lenders often charge origination fees and closing costs.

- Unfavorable rates: Borrowers, particularly those with fair-to-bad credit, may be unable to qualify for low interest rates on new financing.

- Negative impact on your credit score: Debt settlement, in particular, can do damage to your credit as, among other factors, you’re essentially failing to repay loans as originally agreed.

How Does Debt Consolidation Affect Your Credit Score?

Debt consolidation can affect your credit score in both the short term and the long term, depending on how the loan is used and how you manage repayment afterward.

Short-Term Impact

Applying for a debt consolidation loan typically triggers a hard credit inquiry, which may cause a small, temporary drop in your credit score. Opening a new loan can also affect your credit mix and average account age, which are additional factors in credit scoring models.

Long-Term Impact

Over time, debt consolidation can improve your credit if it helps you make consistent, on-time payments. Paying off high-interest credit cards and reducing revolving balances can improve your credit utilization ratio, a key component of your credit score.

If the consolidation loan replaces multiple missed or late payments with a single, manageable payment, your payment history may also improve, further supporting your credit score.

When Debt Consolidation Can Hurt Your Credit

Debt consolidation may negatively affect your credit if:

- You miss payments on the new loan

- You continue to use credit cards and accumulate new debt after consolidating

- You close old credit accounts in a way that significantly increases your credit utilization

In addition, some alternatives to consolidation—such as debt settlement programs—can have a more severe negative impact on your credit score, particularly if payments are intentionally paused during negotiations with creditors.

| No upfront costs or obligation |

How to Choose the Best Loan for You

Choosing the right debt consolidation loan depends on cost, flexibility, and the level of support a lender provides. The goal is to reduce total borrowing costs while making repayment easier to manage.

Key Factors to Compare When Choosing a Debt Consolidation Loan

APR (Annual Percentage Rate)

APR is the most important metric to compare because it reflects the total cost of borrowing, including interest and lender fees. A lower APR generally means you’ll pay less over the life of the loan, while a higher APR can negate the benefits of consolidation.

Interest rate vs. fees (including origination fees)

Some lenders charge origination fees, while others do not. Fees should always be clearly disclosed and included in the APR. Borrowers with stronger credit profiles may be able to avoid origination fees or have them reduced.

Loan amount and repayment terms

Confirm that the lender offers loan amounts sufficient to cover all of your existing debts. Review repayment terms carefully, as longer terms may lower monthly payments but increase the total interest paid over time.

Flexibility and borrower protections

Lenders vary in their flexibility. Look for features such as:

- Adjustable payment due dates

- No or low prepayment penalties

- Reasonable late payment policies

- Hardship or forbearance options

Additional features may include direct payment to creditors, co-borrower options, and fee waivers for eligible groups such as veterans.

Access to knowledgeable experts

Debt consolidation can be complex. Lenders that offer access to trained representatives who can explain terms, answer questions, and guide you through the process can reduce confusion and help you avoid costly mistakes.

Expert Tip: Vetting Debt Relief Providers

“When choosing a debt consolidation lender or settlement service, clarity is key. Look for plain language, no unexpected fees, and good consumer reviews. Always check their accreditation with such organizations as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).”

| No upfront costs and free consultation |

What Real Borrowers Say About Debt Consolidation

In addition to lender terms and expert guidance, real-world borrower experiences can offer a useful perspective on what works—and what doesn’t—when choosing a debt consolidation loan. Based on recurring themes from consumer discussions in online finance communities, several key lessons stand out.

Many borrowers emphasize that a meaningfully lower APR is essential for consolidation to make sense. Simply combining balances without reducing the overall cost of borrowing often fails to deliver long-term savings. As one borrower summarized, lowering the APR can “unlock more money each month to pay down debt faster.”

Another commonly cited benefit is simplicity. Borrowers frequently point to the value of replacing multiple payments with one fixed monthly payment and a clear payoff date, noting that predictability reduces stress and makes budgeting easier.

Fees are another recurring concern. Borrowers often report overlooking origination fees and other upfront costs, which can reduce or even eliminate the expected savings from consolidation. Reviewing the full APR—not just the advertised interest rate—was a frequent recommendation.

Behavioral discipline also comes up repeatedly. Many borrowers warn that consolidation can backfire if they use credit cards again after paying off their balances. Without changes to spending habits, it’s easy to end up with both a consolidation loan and new revolving debt.

Finally, borrowers stress the importance of transparency and reputable lenders. Positive experiences are often associated with lenders that clearly explain whether consolidation actually makes sense for a borrower’s situation, rather than steering them toward high-fee debt settlement or forgiveness programs.

These insights reflect common themes from consumer discussions and are not financial advice. Individual experiences may vary.

How to Evaluate Debt Relief or Debt Settlement Companies

Debt relief programs follow a different model than consolidation loans and should be evaluated using separate criteria.

1. Reputation and accreditation

Verify that the company is registered with appropriate state agencies and review ratings on third-party platforms such as Trustpilot and the Better Business Bureau. Accreditation from organizations such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA) adds credibility.

2. Eligible debt types and minimum requirements

Most debt settlement companies work only with unsecured debt, such as credit cards. Many require a minimum debt balance—often around $10,000—though thresholds vary by provider.

3. Fees and cost structure

Debt settlement fees typically range from 10% to 25% of the settled amount. Understand when fees are charged, how they are calculated, and whether they are contingent on successful settlements.

4. Transparency and program terms

Review the fine print carefully. Pay close attention to payment handling, program duration, exit options, and any additional fees that may apply.

How to Qualify for a Debt Consolidation Loan

To qualify for a debt consolidation loan, start by reviewing the lender’s requirements. Most lenders consider several factors, including your credit score, income, and debt-to-income (DTI) ratio, which measures how much of your monthly income goes toward existing debt payments.

If your credit score isn’t high enough to qualify for a favorable rate, focus on improving it by checking your credit report for errors, making all loan payments on time, and reducing outstanding debt. Lowering your overall debt can also improve your DTI ratio, which may increase your chances of approval or help you qualify for better terms.

You may also consider applying with a joint applicant or a co-signer with stronger credit, or taking out a secured loan backed by collateral. These options are often easier to qualify for and may come with lower interest rates.

Finally, consider different types of lenders. Traditional banks may have stricter credit and DTI requirements, while online lenders or lenders that specialize in bad-credit loans may offer more flexible qualification criteria.

How to Apply for a Debt Consolidation Loan

Applying for a debt consolidation loan typically follows a straightforward process, though steps may vary slightly by lender.

Step 1: Gather your financial information

Collect details about your income, existing debts, monthly expenses, and personal identification. Having accurate information ready can speed up the application process and reduce errors.

Step 2: Check your options and prequalify

Compare lenders and prequalify when possible. Many lenders offer prequalification with a soft credit check, allowing you to view potential rates, loan amounts, and terms without impacting your credit score.

Step 3: Choose a lender and submit a full application

Once you’ve selected a lender, complete the formal application. This typically involves a hard credit inquiry and may require documents such as proof of income or bank statements.

Step 4: Review loan terms carefully

Before accepting the loan, review the APR, repayment term, monthly payment, and any fees, including origination or prepayment fees. Make sure the terms fit your budget and repayment goals.

Step 5: Confirm how funds will be distributed

Verify whether the lender will pay your creditors directly or deposit the funds into your bank account so you can pay off the debts yourself.

Step 6: Pay off existing debts and manage accounts

Ensure all consolidated debts are fully paid off. Consider setting up automatic payments on the new loan and managing or closing old accounts responsibly to avoid missed payments or new debt.

Comparing the Top Debt Consolidation Loans and Companies

| Provider | Service Type | Geographic Availability | Credit Score Requirement |

| Freedom Debt Relief | Debt settlement | 41 states | Not required |

| National Debt Relief | Debt settlement | 46 states | Not required |

| JG Wentworth | Debt settlement + loan referrals | 43 states | Not disclosed |

| Accredited Debt Relief | Debt settlement + loan referrals | 37 states | Not disclosed |

| Achieve | Debt settlement + consolidation loans | 39 states | ~620 for loans |

| ClearOne | Debt settlement only | Limited availability | Not required |

| Americor | Debt settlement + loan option | All 50 states | Not required |

| Pacific Debt Relief | Debt settlement + referrals | Most states | Not required |

| Consolidated Credit | Debt settlement + counseling | All 50 states | Not required |

| Upgrade | Debt consolidation loans | Most states | ~580 |

| Lending Club | Debt consolidation loans | All 50 states | ~600 |

| Reach Financial | Debt consolidation loans | Limited states | Not disclosed |

Alternatives to Debt Consolidation

Debt consolidation loans aren’t the right solution for everyone. Depending on your credit profile, debt type, and financial goals, one of the following alternatives may be a better fit.

Balance Transfer Credit Cards

Some credit cards offer promotional balance transfer periods with low or 0% introductory APRs. Transferring existing balances to one of these cards can help you save on interest while paying down debt.

Be aware that once the promotional period ends, any remaining balance will begin accruing interest at the card’s regular APR. You’ll want to pay off as much of the balance as possible before that happens. Also, confirm that the offer does not include deferred interest, which can retroactively apply interest if the balance isn’t paid in full by the end of the promotion.

Home Equity Loans or HELOCs

Home equity loans and home equity lines of credit (HELOCs) allow you to borrow against the equity in your home. These options often come with lower interest rates and longer repayment terms than unsecured loans.

However, because your home is used as collateral, failure to repay the loan could result in foreclosure. This option may be appropriate for borrowers with stable income who are comfortable taking on secured debt.

Credit Counseling

Credit counseling services can help you better understand your finances, create a budget, and develop a plan to repay debt. Nonprofit credit counseling agencies may also offer debt management plans that reorganize payments and potentially reduce interest rates without taking out a new loan.

This option can be helpful if you’re feeling overwhelmed or unsure where to start.

Debt Repayment Strategies

In some cases, you may not need a new loan at all. Structured repayment strategies can help you pay off debt faster using your existing accounts.

- Snowball method: Focus on paying off the smallest balances first to build momentum

- Avalanche method: Prioritize debts with the highest interest rates to reduce total interest paid

These strategies require discipline but can be effective if your debts are manageable and you can make consistent payments.

Our Bottom Line

Debt consolidation can be an effective way to simplify repayment and reduce interest costs, but it isn’t a one-size-fits-all solution. The right approach depends on your credit profile, debt mix, financial habits, and long-term goals. Whether you choose a consolidation loan, a structured program, or an alternative strategy, the most important factor is pairing the solution with consistent repayment and healthier spending habits. Taking the time to compare options carefully and understand the trade-offs can help you choose a path that supports lasting financial stability.

Compare With BestMoney.com, Choose the Best for You

At BestMoney.com, we understand the importance of making informed financial decisions. Our team of financial experts and editors conducts thorough research across lending, banking, home loans, personal finance, and insurance to provide you with comprehensive comparisons and insights. We continuously update our content to reflect the latest market trends and offerings, ensuring you have access to current, reliable information.

We offer a wide range of services including detailed comparison tools and expert reviews, all designed to meet your specific financial needs. Our mission is to empower you to make confident, well-informed choices that help you achieve your financial goals.

Methodology

How We Selected the Best Debt Consolidation Lenders

We evaluated debt consolidation lenders and debt relief services using a standardized set of criteria focused on cost, availability, usability, and customer experience.

Availability and eligibility

We reviewed each company's operating locations, state availability, eligibility requirements, and the types of debt covered, including whether services apply to unsecured debts such as credit cards and personal loans.

Rates, fees, and repayment flexibility

We compared APRs, interest rates, origination fees, and other costs. We also assessed repayment flexibility, including loan terms, prepayment penalties, hardship options, and features like direct creditor payment.

Online experience and customer support

We evaluated website clarity, application ease, digital tools, customer service channels, years in business, and consumer feedback from platforms like Trustpilot and the Better Business Bureau (BBB).

Consumer experience insights

We considered recurring themes from consumer discussions in online finance communities to better understand transparency, usability, and common borrower concerns.

Companies that performed well across most or all of these areas were considered for our Best of lists and sub-lists.

Frequently Asked Questions About Debt Consolidation

1. Can debt consolidation save me money?

By rolling all your debts and interest rates into one loan and paying at least the monthly minimum, if not more, you may save money. Keep in mind that, in order to save money, the interest on your debt consolidation loan should be lower than the highest interest rate you’re currently paying on other loans or credit card debts.

2. Can debt consolidation help get me out of debt sooner?

Debt consolidation may help you get out of debt sooner. By making a single monthly payment rather than multiple payments and having a single interest rate rather than many, you may find a faster, simpler path to paying off your debts, leaving fewer opportunities for mistakes, such as missed payments.

3. Where can I get a loan?

Many lenders offer debt consolidation loans, including Freedom Debt Relief, SoFi, National Debt Relief, Upgrade, and more. Make sure the lender you work with offers loans in your state.

4. What's the difference between secured and unsecured loans?

Secured loans, which may be easier to qualify for with a lower credit score, use an asset like property or cash to secure the loan in case you are unable to pay it. An unsecured loan does not require collateral and may have stricter qualification requirements.

5. How do I choose the best debt consolidation loans?

Compare what different lenders — both traditional banks and online lenders — have to offer. Start with the loans you qualify for based on the amount of debt you want to consolidate and your credit score. Then look at interest rates and choose the lender with the best debt consolidation loan. Finally, ensure the loan terms fit your budget and financial goals.

Author Insights by Brian Acton

- Choose a debt consolidation loan with a much lower APR than your current debts—the bigger the drop, the lower your payment and total interest paid.

- Debt relief programs can lower what you owe and roll debts into one payment, and may be easier to qualify for than consolidation loans. But they usually require missed payments, which can hurt your credit for years.

- When comparing debt consolidation loans, focus on the APR, not just the interest rate. APR reflects the total borrowing cost, including fees.

- Online lenders often offer quick prequalification, easy applications, and competitive rates, while banks may provide loyalty discounts and in-person support.

- Secured consolidation loans can offer lower rates by using collateral like your car, but you risk losing it if you fall behind on payments.

Our Top 3 Picks

1. Freedom Debt Relief

| Our best for mobile management |

Why we picked Freedom Debt Relief as a top debt settlement company:

Freedom Debt Relief offers debt settlement services, meaning it’ll negotiate down the amount you owe your creditors and manage the repayment. It specializes in unsecured debt, like outstanding credit card balances, medical bills, and personal loans.

Freedom’s mobile app allows you to manage settlement offers, track repayment progress, and see how much you’re saving on the go. It also happens to be the highest-rated mobile app, among the companies we reviewed, scoring 4.8 out of 5.0 stars on Google Play and 4.9 out of 5.0 stars on the Apple App Store.

How to qualify:

- Live in one of the 41 states where Freedom Debt Relief does business

- Have at least $7,500 in qualifying debt

- Accept a debt settlement offer to start the program

Customer service at a glance

- Trustpilot score: 4.6

- BBB rating: A+ (BBB accredited)

- Common complaints? Negative effects on credit scores, lack of refunds after termination of services

- Common praise? Positive customer service experiences, successful debt negotiations

- Contact channels: Phone (833-582-7700), email (info@freedomdebtrelief.com)

Expert intel:

When we tried to contact the email address listed on Freedom Debt Relief’s website, we received a bounce-back message saying the company wasn’t accepting messages from people outside its organization. When we called the phone line, we felt rushed toward a resolution: either making a sale, being transferred to another department, or getting off the phone.

PROS

- Free consultation

- Above-average Trustpilot score for the industry

- Debt consolidation loan referrals through affiliated partners

CONS

- 15% to 25% debt settlement fee

- Not available in eight states

- Problems reaching the company via email

2. National Debt Relief

| Our best for a variety of financial services |

Why we picked National Debt Relief as a top debt settlement company:

National Debt Relief is a debt settlement service that negotiates your debts, then manages payments through an escrow fund.

The company also offers a broad range of services through partners, including debt consolidation loans, credit counseling, and bankruptcy referrals.

How to qualify:

- Live in one of the 46 states where National Debt Relief does business

- Have at least $10,000 in qualifying debt

- Accept a debt settlement offer to start the program

Customer service at a glance

- Trustpilot score: 4.7

- BBB rating: A+ (accredited)

- Common complaints? High fees, lack of progress with debt resolution

- Common praise? Transparent communications, easy enrollment process

- Contact channels: Phone (800-300-9550)

Expert intel:

National Debt Relief is available later than many other companies, with phones open until midnight during the week, 11 p.m. ET on Saturdays, and 10 p.m. ET on Sundays. But the first time we called, we couldn’t reach a representative because the answering service did not register the menu selections we made on our phone’s keypad. The second time, we got a message stating that we were calling outside business hours, even though we were within the customer service hours listed on the website.

PROS

- Free initial consultation

- Access to a partner network with other financial services

- Multiple accreditations within the debt relief industry

CONS

- 15% to 25% debt settlement fee

- Problems reaching the company via phone

- Not available in four states

3. JG Wentworth

| Our best for debt settlement from a well-known name |

Why we picked JG Wentworth as a top debt settlement company:

JG Wentworth offers debt settlement and can refer you to debt consolidation loans from MoneyLion. With 32 years in business, it is the oldest debt settlement company on this list, and also offers structured settlements, access to cash by selling your annuity payments, and referrals for credit cards, insurance, and home improvement companies.

How to qualify:

- Live in one of the 43 states where JG Wentworth does business

- Have $10,000 or more in qualifying debt

- Accept a debt settlement offer to start the program

Customer service at a glance

- Trustpilot score: 4.8

- BBB rating: A+ (accredited)

- Common complaints? Non-responsive customer service, payment issues

- Common praise? Positive experiences with specific customer representatives

- Contact channels: Phone (888-570-5240), email (debt@jgwentworth.com)

Expert intel:

“JG Wentworth [is a] reputable debt relief and consolidation [company] that I have referred clients to when they wouldn’t qualify for bankruptcy.” – Derek Jacques, bankruptcy attorney and owner of the Mitten Law Firm.

PROS

- Decades of experience in the debt settlement industry

- Legal insurance is available for an additional monthly fee

- 24/7 customer support

CONS

- No mobile app

- Higher debt settlement fees of 18% to 25%

- Not available in seven states

Disclaimers

BestMoney.com provides general educational information and comparisons and does not provide financial, legal, or tax advice. Consider consulting qualified professionals and confirming current terms directly with lenders/providers.

www.bestmoney.com/debt-consolidation is powered by Natural Intelligence

6 Tozeret Haaretz St | Tel Aviv, Israel | +972-72-2723840