This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which may impact the location and order in which brands (and/or their products) are presented, and may also impact the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

Send doesn't charge any fees for money transfers. However, other organizations that take part in the transfer process, like intermediary or beneficiary banks, may have surcharges for transactions or processing.

These third parties can charge for forwarding or receiving funds. Additionally, there may be fees generated if a payment fails. These charges vary depending on the policies of those third parties. Send can't usually predict the amount for any given transfer.

Send doesn't have control over third party fees and can't absorb them. As a result, they pass them onto the customer. Clients who need to guarantee that a specific amount arrives in the foreign currency will want to consider this when sending funds.

Signing up with Send is straightforward:

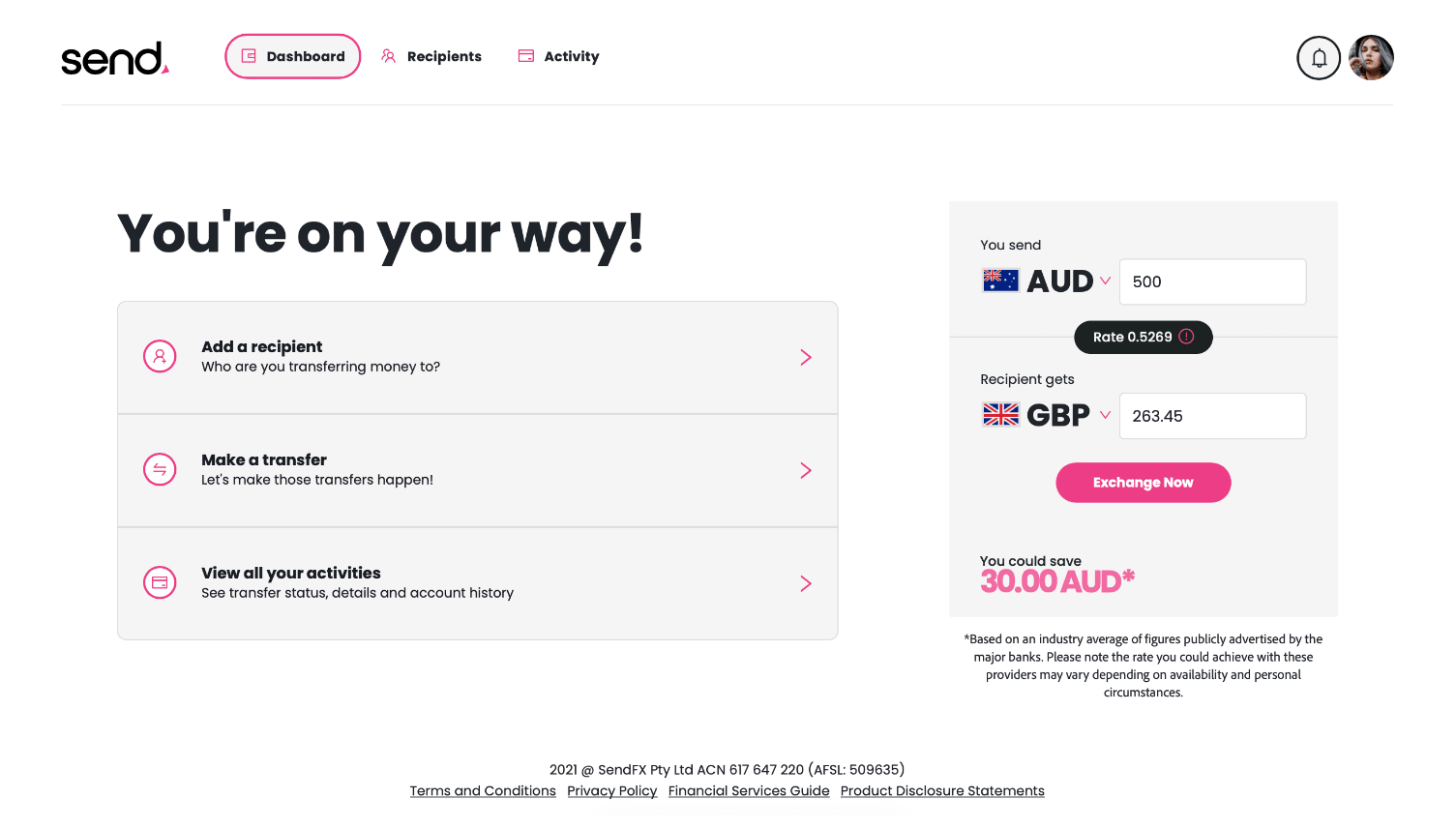

Once you're inside the Send platform, you can generate as many transfer quotes as you like. The exchange rates are available in the form of a currency exchange calculator.

If you decide to use the service, you'll need to input your personal or business information. Send will also request details from your passport or driver's license. You may need to provide other information or documents to meet specific legal requirements.

Send only works with bank account transfers, so, you'll need to provide bank account details during the registration process. The account you use to send funds must be in your name.

After inputting your information, you can proceed with your first transaction, choosing the recipient and the transfer amount. The minimum is $200, and there's no upper limit. You can see the status of all your transactions on the Send portal.

Send can usually complete transfers within 24 to 48 hours after receiving client funds. There are some countries whose banking procedures make processing times longer than that. International holidays can also cause delays.

Send's best features are listed below:

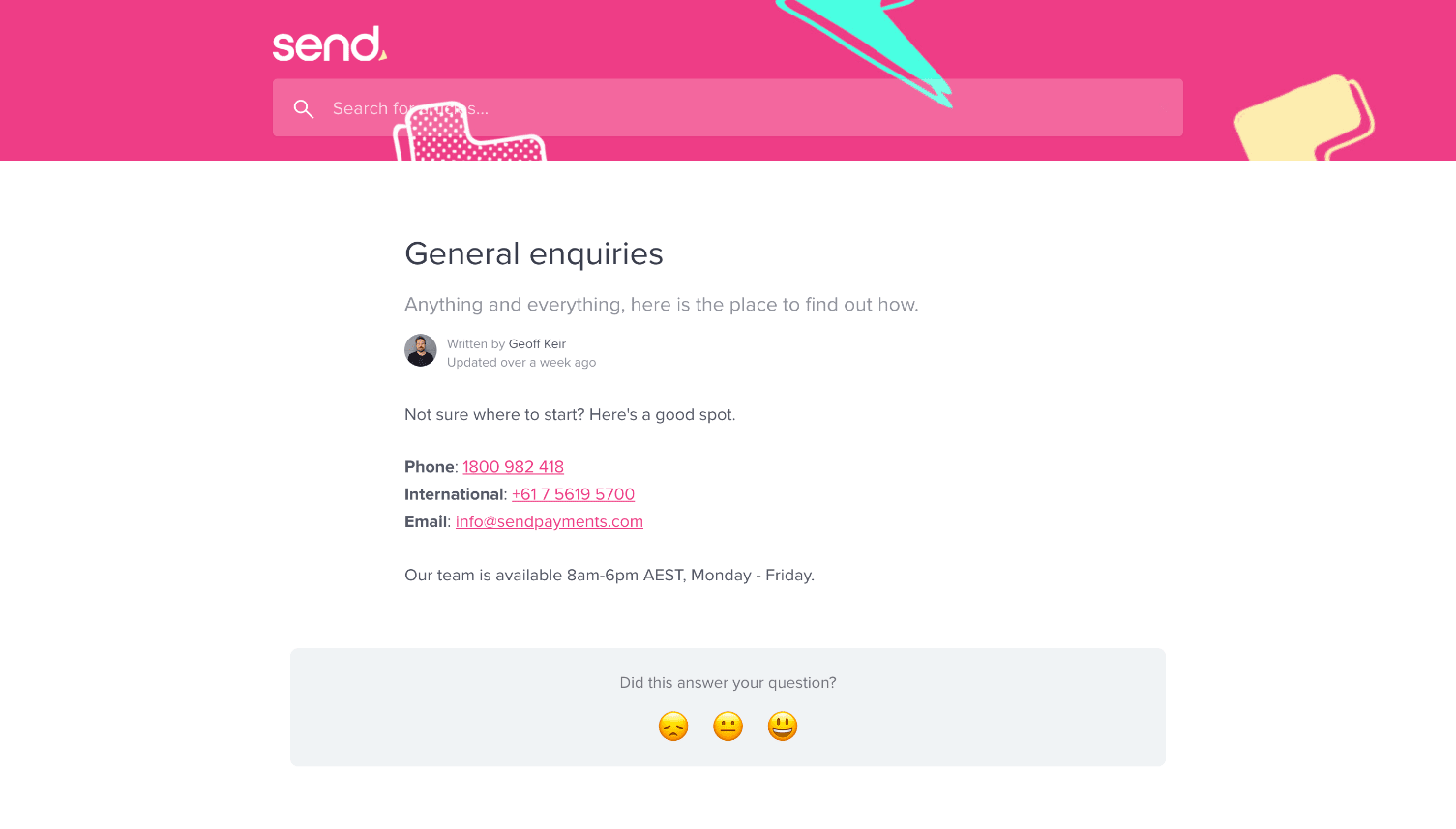

Customer support is available by phone Monday through Friday from 8:00 am to 6:00 pm AEST. The website contains a contact form that users can fill out to send questions. There's also a support page that offers answers to some client queries.

Holders of Send accounts have an assigned account manager who becomes their primary contact. Customers should first contact this person if any problems arise.

Send takes reasonable security measures to make sure customer data and transactions are secure. Standard online protection measures such as authentication processes and encryption help safeguard client information.

Send complies with the Australian Securities and Investments Commission (ASIC) regulations. It has an Australian Financial Services License (AFSL) and is a member of the Australian Financial Complaints Authority (AFCA). Send is also registered with the Australian Transaction Reports and Analysis Centre (ATRAC).

Send offers bank transfers in over 30 currencies, with the option to send money to over 200 different countries. You'll need to have a bank account registered in your name to use this service.

The Send online platform offers a convenient interface for managing your bank transfers. Once you complete the initial registration, you can analyze exchange rates and select a transfer option. You also have access to the status of your transactions from within the platform.

As a Send user, you'll have an account manager assigned to take care of your questions. Send also offers a customer loyalty program for you to opt into.