To uncover the trends shaping the future of Gen Z banking, we examined recent data studies on the subject and surveyed consumers across the country to gain additional insights.

Recent data shows that 72% of Gen Z banking customers now opt for digital-only platforms to handle their financial activities. This shift may reflect a growing trend where convenience, mobile access, and seamless digital experiences are no longer just perks — they are increasingly important for this on-the-go generation.

Let’s delve deeper into recent data about the Gen Z banking landscape, exploring their preferences and expectations. We’ll also provide some easy-to-follow tips for finding the right bank for your financial needs.

Additional Key Takeaways:

Gen Z expects a quality customer experience in their digital banking, with 73% indicating that it heavily influences their choice of financial institution. (Oliver Wyman Forum, 2023)

Data security is a top priority for Gen Z, with 80% trusting their main financial provider. (MX Technologies, 2023)

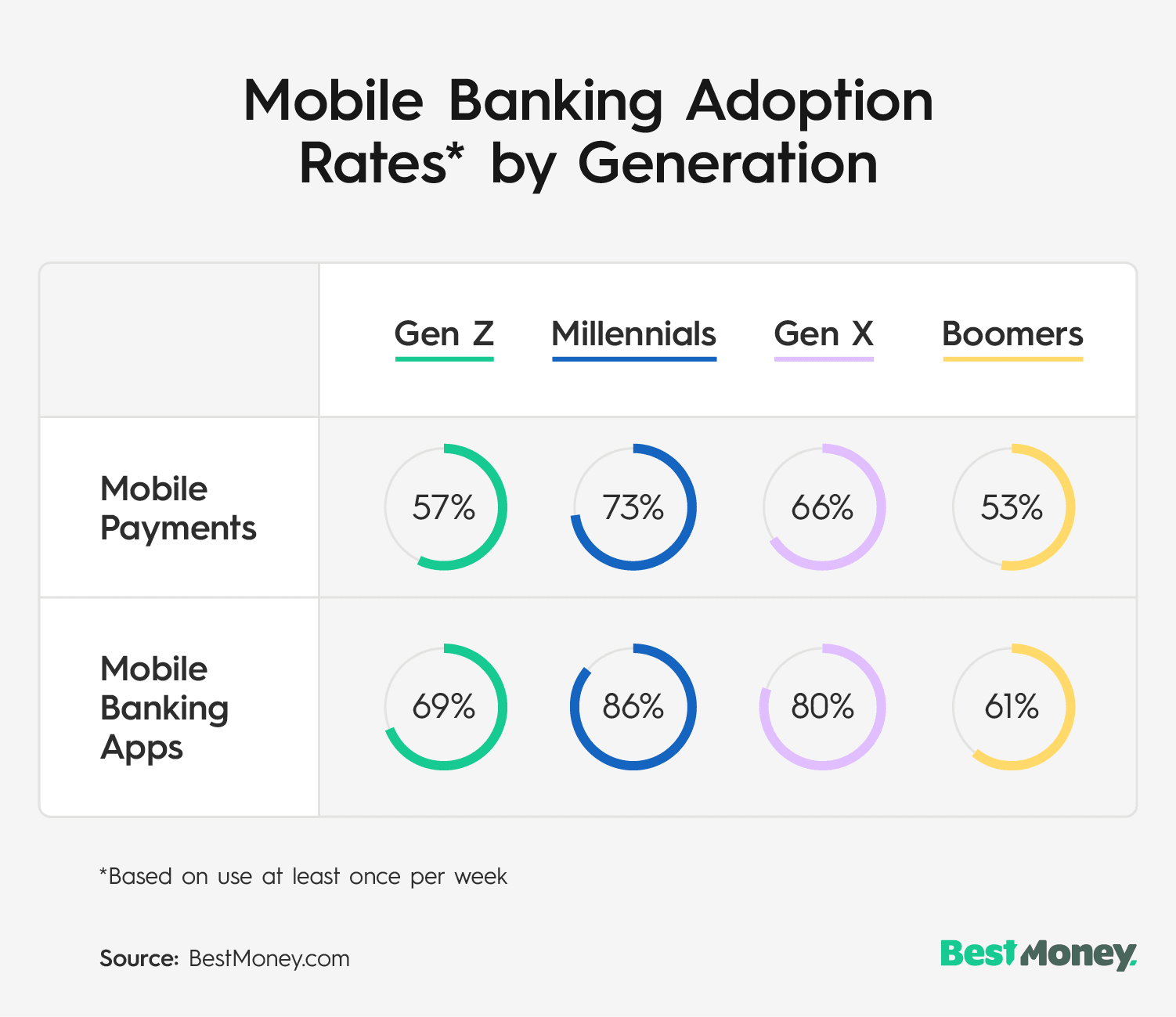

57% of Gen Z use mobile payments at least once a week, while 69% use their bank's mobile app at least once a week. (BestMoney.com, 2024)

42% of Gen Zers switched their primary bank in the last year due to dissatisfaction with mobile banking options. (PYMNTS, 2024)

The Rise of Online-Only Banking Among Gen Z

A 2023 study by the Oliver Wyman Forum found that a staggering 72% of Gen Zers use a neobank — a direct, online-only bank — as their primary budgeting tool. This preference for digital-only financial institutions highlights a significant shift in how younger generations manage their money.

Unlike previous generations, which are more likely to use traditional banks with physical branches, Gen Z gravitates toward platforms that prioritize convenience and flexibility. This digital-first approach aligns perfectly with the fact that 75% of Gen Z feel comfortable making payments through digital tech companies.

As digital natives, Gen Z has grown up with smartphones, high-speed internet, and apps that offer instant access to nearly everything. It's no surprise, then, that they expect the same speed and efficiency in their financial services. Neobanks and fintech platforms often meet these expectations with mobile-first solutions.

Personalization also plays a key role in Gen Z’s embrace of digital banking. According to MX research, 54% of Gen Z consumers would willingly share more personal data with their financial provider if it meant a better banking experience. This willingness to exchange data for personalization underscores the generation's desire for a tailored, predictive, and highly interactive banking experience.

Why Gen Z Chooses Online-Only Banking

For Gen Z, the decision to bank digitally is as much about lifestyle as it is about practicality. Online banking provides the flexibility to manage finances from anywhere, anytime, without the limitations of traditional brick-and-mortar banking hours.

Convenience and Accessibility

While most financial institutions now offer online services, data from Oliver Wyman Forum reveals that 73% of Gen Zers feel that the customer experience they experience online is a critical factor in deciding which brand to trust. Raised on smartphones, this generation values both digitization and an exceptional user experience that integrates convenience and personalization.

This high expectation for digital service quality has made Gen Z extremely mobile-focused. In fact, 42% of Gen Zers switched their primary banking relationships in the last year, largely driven by dissatisfaction with mobile banking options, according to a recent study by PYMNTS.

The demand for accessibility is so strong that Gen Z is 2.5 times more likely to leave their financial institution if mobile services aren’t up to par. For these customers, the ability to manage their finances from anywhere, at any time, is essential.

Privacy and Security Concerns

Despite embracing this digital technology, Gen Z remains highly concerned about privacy and data security. A report from MX Technologies reveals that, when selecting a financial provider, roughly 50% of Gen Zers ranked trust and security among their top priorities. This focus on security highlights that, while Gen Z values convenience, they won’t compromise on safety when it comes to their financial information.

The same survey also revealed that 80% of Gen Zers trust their primary financial service provider to protect their personal data, reflecting a strong sense of confidence in the institutions they choose to bank with.

For online-only banks and fintech companies, delivering a secure experience is crucial to gaining and retaining Gen Z’s loyalty. Offering and clearly communicating robust security features may be key to maintaining trust with this security-conscious generation.

Mobile-First Solutions Are a Priority for Gen Z

As we highlighted earlier, 72% of Gen Zers rely on a neobank app as their primary budgeting tool, underscoring their strong preference for mobile-first solutions. This dedication to their mobile devices extends to how frequently they manage their finances, with 52.5% of Gen Zers checking their accounts at least once per day.

Mobile banking has become a critical tool for this generation.

Our BestMoney survey findings complement this data story. We discovered that 57% of Gen Zers use mobile payment services at least once a week, and 69% regularly access their bank's mobile app. Access to mobile banking is central to their financial habits, from routine payments to more complex tasks like saving, investing, and managing credit.

An academic study published in the Applied Human Factors and Ergonomics journal found that Gen Z primarily uses on-the-go banking for money transfers and payments, underscoring their need for fast, accessible financial solutions that fit their mobile-first habits.

As financial institutions look to appeal to this generation, focusing on a seamless, accessible, and highly responsive mobile experience will be key to earning and maintaining Gen Z’s loyalty.

Majority of Gen Z Is Struggling With Current Financial Situation

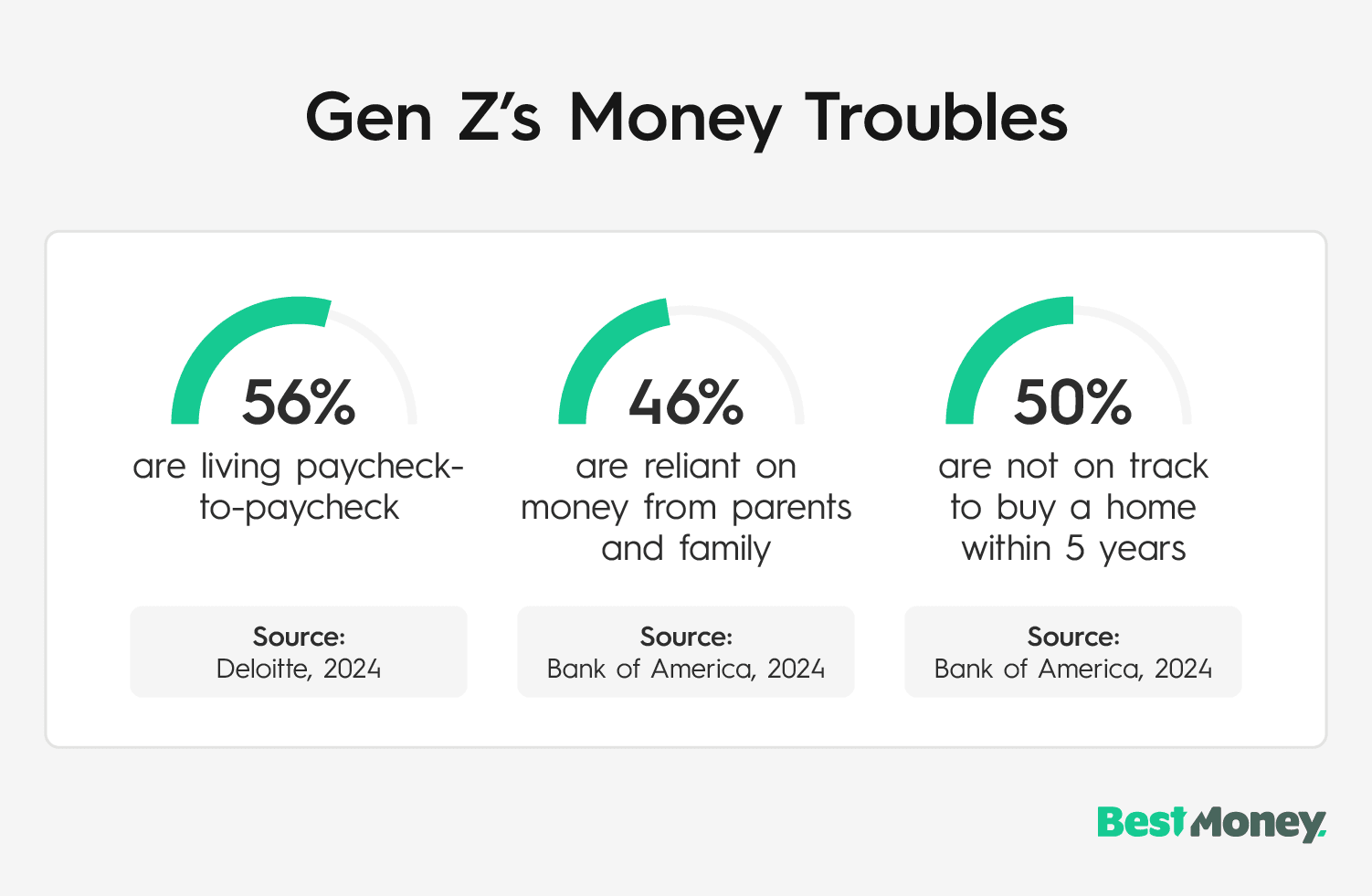

While Gen Z embraces online banking, their financial situation can be precarious. A recent Deloitte Global survey revealed that over half (56%) of Gen Zers are living paycheck-to-paycheck, highlighting a precarious financial situation for this generation. This makes features like easy accessibility and real-time account management through online platforms even more crucial.

With many Gen Zers strapped for cash, managing finances becomes a balancing act. Online banking allows them to check their balance almost instantly, transfer funds quickly, and avoid unnecessary fees associated with traditional banking activities, like missed check payments or ATM withdrawals outside their network.

Gen Z's financial struggles are further highlighted by their reliance on family assistance. According to a Bank of America survey, 46% of Gen Zers (ages 18-27) still rely on financial support from parents and family. That means fewer Gen Zers are taking advantage of the financial tools available through their banks, such as loans and investment strategies.

The financial challenges faced by Gen Z are hindering their ability to achieve key financial milestones. Over half of the Gen Zers surveyed by Bank of America stated that they are not on track to buy a home (50%), save for retirement (46%), or start investing (40%) within the next five years.

44% of Gen Z Turn to TikTok and Instagram for Financial Advice

Despite their financial challenges, Gen Z remains optimistic about their future financial prospects. Nearly half (48%) of Gen Zers expect their personal financial situations to improve over the next year, according to Deloitte. To navigate this journey, they seem to be actively seeking financial guidance and support.

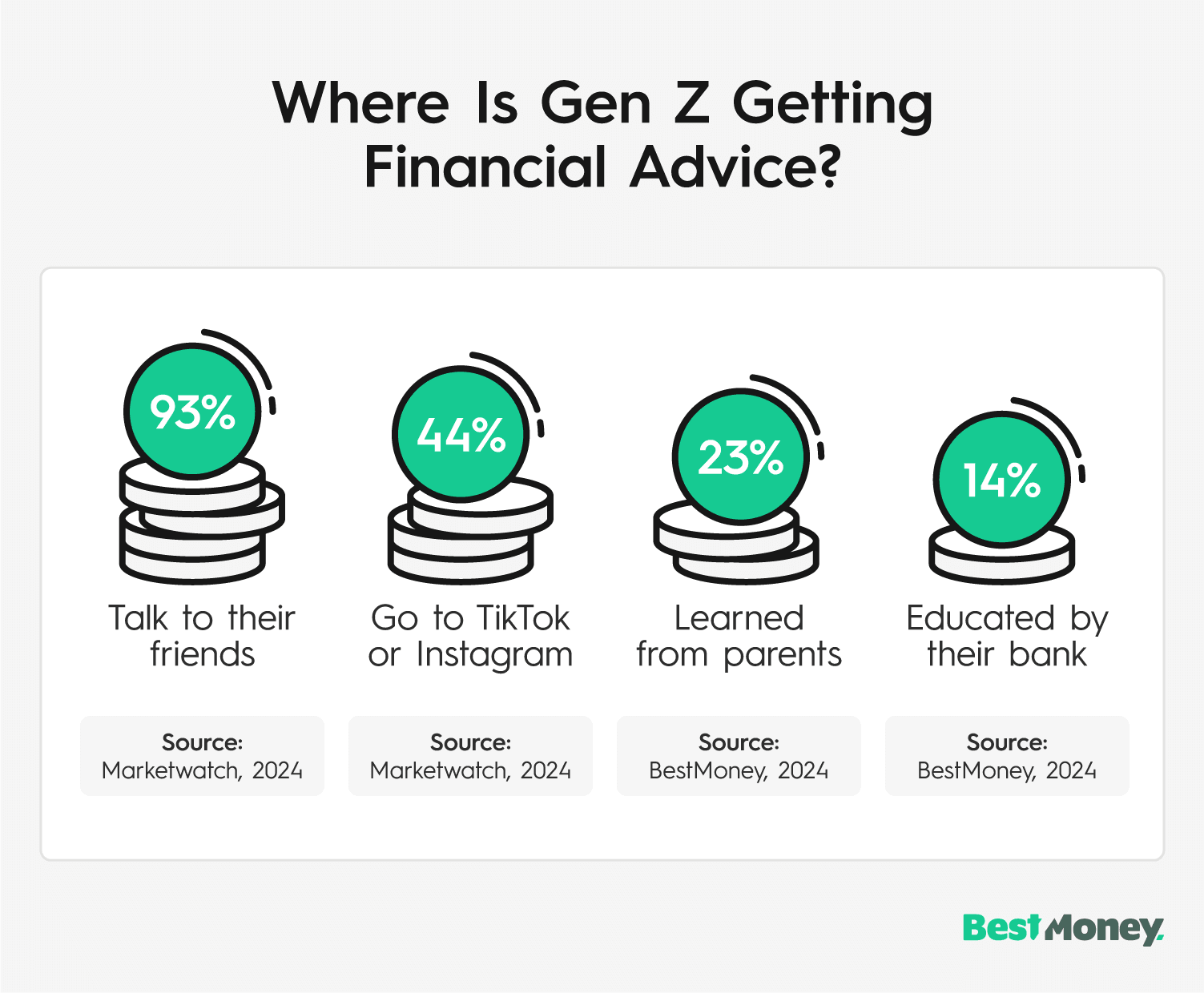

Gen Z is leveraging their social media to seek financial advice. More than a third of both Gen Zers and Millennials trust financial advice from social platforms. This is especially true for Gen Z, with 44% relying on platforms like TikTok and Instagram for financial insights.

While social media platforms provide easily accessible — although not always reliable — financial content, Gen Z understands the potential limitations of this advice. This is evident from the 93% who are comfortable discussing their finances with friends. One-third (33%) claim they do it all the time or frequently.

We found that Gen Z is also more likely than other generations to rely on their bank for financial guidance. When asked about their primary source of financial knowledge, Gen Z ranked their bank (14%) second only to parents (23%).

These statistics highlight Gen Z's desire for a multi-faceted approach to financial education, combining the immediacy of social media with the credibility of established institutions and trusted people. This reflects Gen Z's overall preference for a blended approach to online banking that combines the convenience of digital platforms with the reliability of traditional sources.

Finding the Perfect Bank for Your Lifestyle

With so many banking options available, finding the right fit for your needs and preferences can be overwhelming. Consider the following factors when selecting a bank.

Financial Goals:

Savings: If saving is a priority, look for banks with high-yield savings accounts or competitive interest rates.

Investing: If you plan to invest, consider banks that offer various investment options, such as stocks, bonds, and mutual funds.

Building Credit: If you're looking to build or improve your credit score, choose a bank that offers credit cards with favorable terms and rewards.

Banking Habits:

Online or In-Person: Determine whether you prefer online banking, in-person banking, or a combination of both.

Mobile App Features: If you frequently use mobile devices, look for a bank with a user-friendly and feature-rich mobile app.

Fees and Charges:

Monthly Maintenance Fees: Compare the monthly maintenance fees associated with different account types.

ATM Fees: Consider the fees for using ATMs outside of your bank's network.

Overdraft Fees: Be aware of the fees charged for overdrawing your account.

Customer Service:

Online Reviews: Read customer reviews to get a sense of the bank's customer service reputation.

Branch Locations: If you prefer in-person banking, consider the location and availability of branches.

Tips for Finding the Right Bank

Choosing the right bank may impact your financial well-being. To find the bank that best suits your needs, consider the following tips.

Research and Compare:

Research different banks and their offerings using online tools, like the FDIC’s BankFind Suite or the NCUA’s Research a Credit Union tool, and comparison websites, such as BestMoney.com.

Seek recommendations from friends, family, or colleagues who have experience with various banks.

Read online reviews and customer testimonials to get a sense of the bank's reputation.

Read Fine Print:

Carefully review the terms and conditions of any bank account you're considering. Pay attention to fees, interest rates, and minimum balance requirements.

Be aware of potential hidden fees, such as overdraft fees or foreign transaction fees.

Understand the specific features and benefits offered by each account type.

Consider Your Future Needs:

Think about your short-term and long-term financial goals, such as saving for a home, retirement, or education. Choose a bank that can support your aspirations.

Consider how your lifestyle may change, such as starting a family or changing jobs. Select a bank that can accommodate these potential changes.

Don't Be Afraid to Switch:

Regularly assess whether your current bank is still meeting your needs. If not, don't hesitate to switch banks.

Be aware of any potential costs or fees associated with closing your current account and opening a new one.

Take the time to research new banks that better align with your current and future financial goals.

Feel Empowered Choosing Your Bank

While Gen Zers favor online banking for its convenience, they also value security and trust. This generation expects robust privacy protections, influencing their adoption of mobile payments and apps. Although they are more inclined to embrace digital solutions, a significant emphasis on safety shapes their financial decisions.

Understanding these preferences is the key to finding the right bank for your needs. You can use BestMoney’s online banking tool to explore your options and compare features like online banking, mobile app functionality, and branch availability.

Methodology

A survey of over 400 adults aged 18+ was conducted via SurveyMonkey Audience for BestMoney on September 11, 2024. Data is unweighted and the margin of error is approximately +/-3% for the overall sample with a 95% confidence level.