But while many banks and other financial services offer different ways to send and receive money, their features and efficiency can vary widely.

It’s a good idea to understand the difference between ACH and wire transfers when sending money between some of our best online banks. In this article, we’ll discuss the various methods for transferring money between banks—covering the steps involved, potential costs, and timeframes you could expect.

Methods for Transferring Money Between Banks

ACH Transfers

Automated Clearing House (ACH) transfers are like the unsung heroes of electronic banking. They allow you to move money between different banks with ease, making them perfect for direct deposits and bill payments. While they can clear as quickly as the same business day, some banks might hold onto your funds for a couple of days to keep everything secure.

Speed: Typically up to 3 business days.

Costs: Usually free for both sending and receiving banks.

Accessibility: Available through most banks; easy to initiate online or via mobile banking apps.

Works for: Small to medium amounts, like payroll or paying bills.

Wire Transfers

Need to send a larger sum? Wire transfers are your go-to option. They’re reliable and can be used for both domestic and international transactions. Just remember, while they can often be completed within hours, they might take a few business days to fully clear, depending on the bank’s security checks.

Speed: Domestic transfers usually complete within 1 business day; international transfers may take up to 5 business days.

Costs: Expect fees ranging from $20 to $50; international transfers could be even pricier.

Accessibility: Initiated at banks or credit unions; not available on weekends or holidays.

Works for: Larger sums of money—think real estate purchases or significant gifts.

Third-Party Payment Platforms (p2p)

Several third-party apps make it easy to send money directly to other bank accounts. These apps all operate a bit differently but offer payment and transfer services to individuals and businesses. Here’s how they compare:

PayPal: With PayPal, you can send money between users and transfer funds to and from bank accounts by linking a bank account or debit card. While PayPal itself is free for standard bank transfers, which can take several days, there is a 1.75% fee for instant transfers.

Zelle: Operated by several large banks, Zelle facilitates direct bank-to-bank transfers without holding funds. You can use Zelle through your bank’s app or its own app, and it's always free.

Venmo: Owned by PayPal, Venmo allows transfers between its users once you connect a bank account or debit card. Standard transfers are free and take a few days, but instant transfers cost 1.75%, with fees ranging from $0.25 to $25.

Cash App: This app enables money transfers from your debit card to other users. Link your card, use a phone number or $cashtag to send money, and the recipient can deposit it into their bank. Cash App doesn’t charge for standard transfers, but instant transfers come with a 0.5%-1.75% fee, with a minimum of $0.25.

So, in general, here’s how third-party payment platforms hold up:

Speed: Instant transfers are available; standard transfers may take a few days.

Costs: Generally free for standard transfers; instant options can incur fees ranging from 0.5% to 1.75%.

Accessibility: User-friendly and accessible via mobile apps; requires linking your bank account or debit card.

Works for: Quick peer-to-peer transactions and smaller amounts.

Mobile Check Deposits

If checks are your preferred payment method, mobile check deposits offer a convenient alternative. Most banks now allow you to deposit checks using your smartphone by taking pictures of them. However, this method may take a few days for the funds to clear.

Speed: Typically takes 3 to 5 business days to clear.

Costs: Usually free, depending on your bank's policies.

Accessibility: Requires a smartphone and a compatible banking app.

Works for: Depositing checks without needing to visit a bank branch.

International Money Transfers

You have several methods to choose from when sending money internationally, including wire transfers and payment apps. Each option comes with distinct fee structures, limits, and transfer times:

Speed: Wire transfers can take up to 5 business days; payment apps vary based on location.

Costs: Fees can range from $20 to $50 or more for wire transfers; payment app fees vary widely depending on the destination.

Accessibility: Wire transfers require bank involvement; payment apps are often easier but depend on availability in both countries.

Works for: Sending money abroad or paying international bills.

How Long Does It Take to Transfer Money Between Banks?

Transferring money between banks can happen instantly or take a few business days, depending on the type of transfer you choose. Here’s a quick comparison of different types of bank-to-bank money transfers—and how long they might take:

Type of Transfer | Transfer Time | Fees |

|---|---|---|

ACH | Up to 3 business days | None |

Wire transfer | Domestic: 1 business day International: Up to 5 business days | Domestic: Up to $30 International: Up to $50 (or more) |

Payment app | Standard transfer: Up to 5 business days Instant transfer: A few minutes | Standard transfer: Free Instant transfer: Up to 1.75% |

Money transfer provider | Domestic transfer: 1 business day International: Up to 5 business days | Varies |

Mobile check deposit | Up to 3 - 5 business days | None |

Understanding Fees Associated With Bank Transfers

There are several fees you may be charged for transferring money from one bank to another. Here are a few to watch out for:

Instant transfer fees: While most payment apps don’t charge for standard transfers, opting for an instant transfer often comes with a fee. This fee typically ranges from 0.50% to 1.75% of the transferred amount, depending on the app and the total payment. Standard transfers may take a few business days, but instant options allow for faster access to funds at a cost.

Wire transfer fees: Wire transfers almost always incur fees, charged by the financial institution initiating the transfer. These fees can range from $15 to $50, depending on whether you’re sending or receiving money, and whether the transfer is domestic or international.

Currency conversion: When sending money internationally, your currency is converted to the local currency of the recipient’s account. Currency conversion usually involves a small percentage fee based on the total amount being transferred.

Transferring Your Money to Yourself at a Different Bank

If you manage accounts at multiple banks, you might need to move money between them. Here are a few common methods:

Wire transfer: You can use a wire transfer to move funds between your accounts at different banks. Wire transfers typically offer higher limits and are processed on business days, but you may be charged fees on both the sending and receiving ends.

ACH transfer: Many banks allow you to initiate an external transfer through ACH to move money to another bank account you own. This can be done manually or through a service. ACH transfers are usually free but may take a few days to fully process.

Third-Party Payment Platforms: If both of your banks support the same third-party payment platform, you can use it to transfer money between your accounts. This option often provides faster transfers, though some platforms may charge fees for instant transfers.

How Do You Transfer Large Sums of Money?

Most transfer methods come with daily or weekly limits on how much you can send. If you need to move a large amount, here are some options that offer higher limits and reasonable fees:

Bank wire transfer: Banks and financial institutions typically allow large sums to be sent through wire transfers. It’s a secure option with a flat fee, usually $50 or less. This method works well for down payments, financial gifts, or big purchases.

Wire transfer apps: Some apps let you transfer large sums with lower fees, even for high amounts. These platforms allow transfers of tens of thousands of dollars while keeping fees more reasonable than other payment options. For security, you might need to provide extra documentation to verify your identity and the recipient’s details.

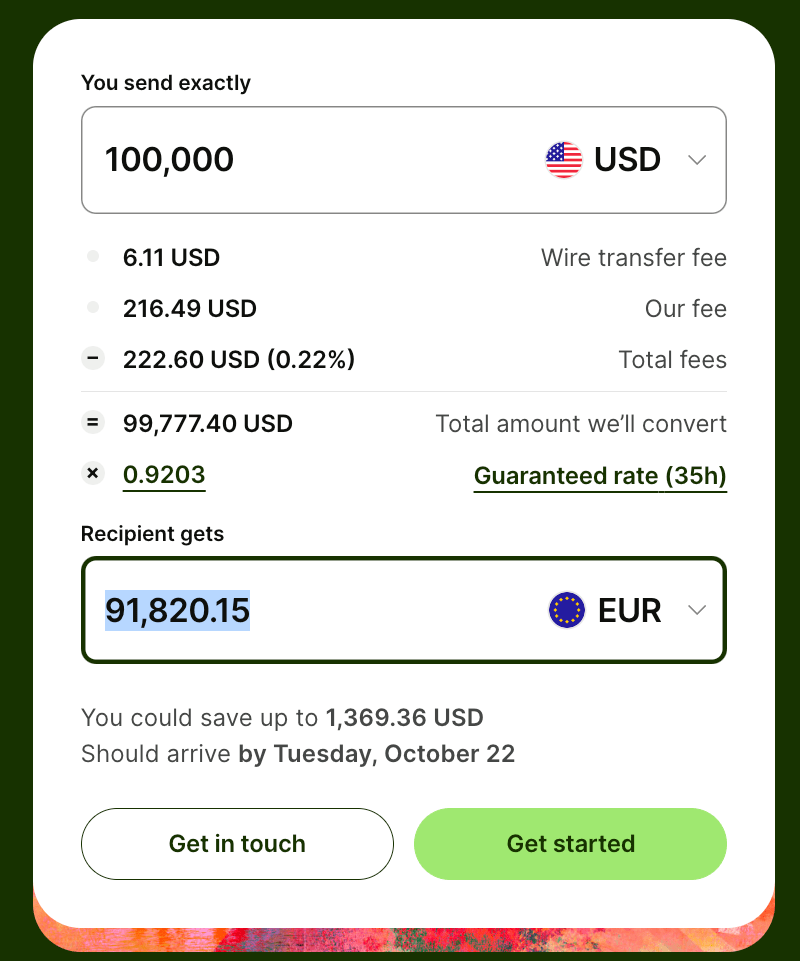

Large wire transfer example

If you need to send a large sum of money (say, $100,000), you can see the fees and time it may take to transfer using certain payment apps. If you transfer from U.S. Dollars to someone in Europe, there are two main fees charged:

Wire transfer fee: $6.11

Typical third-party app fee: $216.49

This means that $222.60 (0.22%) will be deducted from the $100,000 transfer, and the remaining $99,777.40 will be converted to Euros. The app will show the conversion rate and the total amount of Euros the recipient will receive. In this case, sending $100,000 will convert to €91,820.15.

Troubleshooting Issues During Bank Transfers: Common Problems and Solutions

Bank transfers don’t always go smoothly, and there might be a lot you’re unsure of with money transfers. Here are a few common issues you may encounter:

- Sending the wrong amount: If you accidentally transfer the wrong amount, fixing the issue may take some time. For overpayments, you’ll need to contact the receiving institution and request a refund for the excess. Banks often place holds on larger transfers, which can help resolve this issue more smoothly. If you send too little, you’ll need to make a second transfer to cover the difference.

- Sending on a weekend or holiday: Transfers made on weekends or banking holidays may experience delays. For example, if you transfer money on a U.S. holiday like Thanksgiving, expect a delay of about four days until the bank reopens.

- Payment delayed: Various factors can delay a transfer, such as banking holidays, security holds, or fraud prevention checks. You might be asked to provide additional information or verify your identity to move things along. In some cases, the recipient just has to wait a few days for the funds to clear.

- Entering the wrong bank details: Mistyping bank details can cause your transaction to be rejected or sent to the wrong account. In such cases, you’ll need to work with both your bank and the receiving bank to correct the error. Resolving this may take some time, especially if fraud concerns arise.