This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which may impact the location and order in which brands (and/or their products) are presented, and may also impact the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

Legal & General America offers term life insurance policies of 10, 15, 20, 25, 30, 35 and 40 years, and at competitively low costs compared to the industry standard. For example, a 20-year-old female non-smoker in excellent health purchasing a 10-year term life insurance policy with a $100,000 face value would pay as little as $8 monthly premium. A 45-year male non-smoker with average health, purchasing a 20-year policy with $1 million face value, might pay between $137 to $159 per month.

Legal & General America offers competitive rates and certain considerations to people with pre-existing conditions such as diabetes, anxiety, or high blood pressure. Unlike some competitors, Legal & General America also offers positive health credits for people who may have a medical issue but live a healthy and fit lifestyle overall.

Flexibility is one of the main features of Legal & General America’s service: payments can be made in several different frequencies, policies can be converted without losing the original terms, and there are several rider options that can be tailored to fit each customer’s needs.

Term Life Insurance is typically the most popular and is designed for people with temporary needs or is on a limited budget. It provides protection for a specific period of 10 to 40 years.

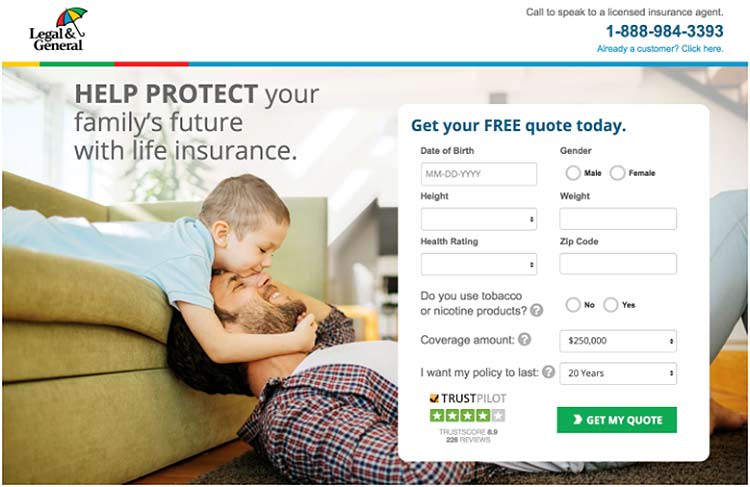

A free quote can be obtained quickly and easily through the Legal & General America website or over the phone. The next step is the pre-application process, which begins with a brief introductory call with a licensed agent to help you assess your coverage needs. Once your needs are determined, a follow up interview may be scheduled at your convenience to complete an application, or you may be able to apply directly online. That portion of the process takes about 20-45 minutes and you will need to have on hand:

Some applicants may be required to take a brief, no-cost medical exam lasting about 20-30 minutes.

If you would like to learn more about other products Legal & General America offers, please visit the website.

With 70+ years of operation in the United States and $782 billion of life insurance in force in 2020, Legal & General America is one of the best life insurance companies in the country. Based on a 2021 LIMRA report, Legal & General America is the #1 provider of term life insurance in the US, issuing more than $63 billion that same year. It has a superior or very strong rating from all three of the major financial strength ratings agencies, meaning customers can be confident in its financial stability.

Legal & General America prides itself on achieving a 4-star review from Trustpilot and values customer feedback. The team is licensed and equipped to help you get the right coverage to fit your needs. Once you have a policy, you can update most of your information online. Existing policyholders can also quickly reach a friendly customer care representative via phone or email..

People looking for competitively priced life insurance from a company with financial strength and an excellent reputation need look no further than Legal & General America. Through a commitment to delivering a small selection of life insurance packages at an excellent standard, Legal & General America has become one of the largest life insurance providers in the United States.

Legal & General America

3275 Bennett Creek Avenue

Frederick, Maryland 21704

United States

Legal & General America Disclosure

Legal & General America life insurance products are underwritten and issued by Banner Life Insurance Company, Urbana, MD and William Penn Life Insurance Company of New York, Valley Stream, NY. Banner products are distributed in 49 states and D.C. William Penn products are available exclusively in New York; Banner does not solicit business there. Financial strength ratings as of 2021. The Legal & General America companies are part of the worldwide Legal & General Group. 18-143*OPTerm policy form # ICC12OPTN and state variations. OPTerm policy form in NY is #OPTN-NY. The OPTerm life insurance premiums quoted are based on the information provided. The quote does not take into consideration complete medical history, occupational risks or other avocations. Approval and actual premiums will be based upon the entire underwriting process, including but not limited to information provided on the application, exam results and specific underwriting requirements and criteria. Premium rates vary by underwriting classification and coverage amount. Premium rates vary by coverage amount: $100,000-$249,999, $250,000-$499,999, $500,000-$999,999, $1,000,000 and above. Premiums quoted include $90 annual policy fee. Premiums are guaranteed to stay level for the initial term period and increase annually thereafter. OPTerm policies can be issued in preferred plus non-tobacco, preferred non-tobacco, standard plus non-tobacco, standard non-tobacco, preferred tobacco and standard tobacco classes. OPTerm 10, 15, 20, 25 and 30 substandard policies can be issued through Table 12, subject to underwriting discretion. Coverage can be renewed to age 95. Policies can be returned without obligation within 30 days of receipt in most states. Two-year contestability and suicide provisions apply. Policy descriptions provided here are not a statement of contract. Please refer to the policy forms for full disclosure of all benefits and limitations. Rates as of 07.29.22.