This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We provide free access to our comparison tools and helpful content through advertising compensation from companies that appear on our site. While this compensation may influence which products we write about and where they appear on the site, it does not affect our reviews or opinions. Our partners cannot pay us to secure favorable reviews or recommendations. Company listings on this page do not imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

Disclosure: Opinions expressed here are author's alone, not those of any bank, credit card issuer, airlines or hotel chain.

Cardholders also get 50% more value for points when they redeem them for travel through Chase, along with perks like a $300 annual travel credit, Priority Pass Select, and Chase Sapphire airport lounge membership and fee credits toward Global Entry, NEXUS, or TSA PreCheck membership every four years.

The Chase Sapphire Reserve® charges a $550 yearly fee, yet paying this much can be worth it if you use the card's rewards and benefits. Before you commit, however, you should learn all about its rewards rates, redemption options, fees, and features.

As a premium travel credit card, the Chase Sapphire Reserve® tailors its rewards to people who spend most on travel and dining. New cardholders can earn a generous sign-up bonus in the early months of card ownership, followed by lucrative rewards for travel purchases and restaurant spending worldwide.

The card's rewards program, Chase Ultimate Rewards, is also known for its flexibility for frequent travelers and non-travelers. The fact the Chase Sapphire Reserve® offers 50% more value for travel booked through Chase (e.g., airfare, hotels, rental cars, and more) is another standout benefit.

While the Chase Sapphire Reserve® doesn't offer bonus rewards in everyday spending categories, it does reward cardholders for their travel and dining purchases. Regular spending on the card earns a standard rate of just 1X points per dollar spent.

Cardholders who choose the Chase Sapphire Reserve® can earn:

The card's sign-up bonus is offered on top of rewards for spending: Earn 60,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Expert intel: If you are wondering how much in rewards you might earn with the Chase Sapphire Reserve® in a given year, imagine you spend the following amounts in the card's bonus categories (and on regular purchases) in the average month:

In this scenario, a cardholder would earn 8,500 points per month on their spending and 102,000 points over one year. Add the sign-up bonus, and they would earn 162,000 Chase Ultimate Rewards points during the first year as a cardholder.

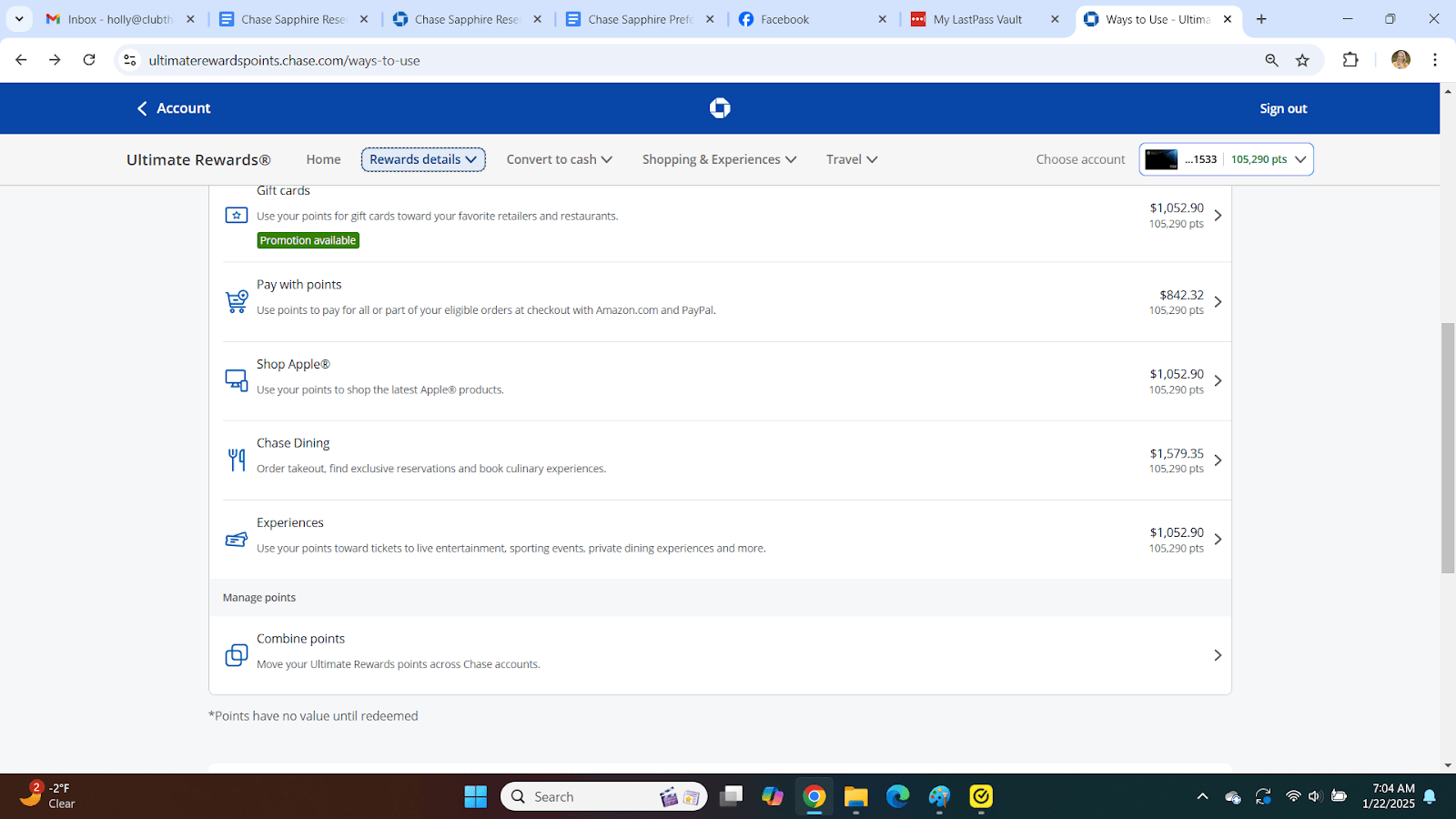

Like other travel credit cards in the Chase Ultimate Rewards universe, the Chase Sapphire Reserve® offers flexible redemption options, including travel and non-travel options.

Non-travel redemption options with the Chase Sapphire Reserve® include:

Note that the majority of these redemptions get you 1 cent per point in value, meaning 60,000 points are worth $600 in cash back, statement credits, and gift cards. Values for merchandise redemptions vary depending on where you redeem, but point redemptions through PayPal and Amazon.com have an average value of 0.8 cents per point.

Expert intel: A major standout benefit of the Chase Sapphire Reserve® is that cardholders get 50% more value for travel when using points through Chase. This perk allows consumers to book hotel stays, car rentals, airfare, and activities with a rewards value of 1.5 cents per point. Also, this benefit is why materials on the card say the sign-up bonus (currently 60,000 points) is worth $900 if redeemed for travel.

The Chase Sapphire Reserve® also lets cardholders transfer points to a selection of hotel and airline partners at a ratio of 1:1. You must transfer rewards in increments of 1,000 points.

Chase transfer partners include:

Airlines:

Hotels:

We awarded the Chase Sapphire Reserve® an average score of 4.7 out of 5 based on our credit card review methodology. This score reflects its high rankings in categories like Features and Benefits, Card Security, and User Experience while also taking lower scores for the card's Customer Service and Rates and Fees into account.

The sections below explain our basis for these ratings in each review category.

The Chase Sapphire Reserve® charges an annual fee of $550, which is higher than the industry standard for travel credit cards. It also has a high variable APR for purchases and balance transfers. This card does not charge foreign transaction fees, making it a solid option for frequent international travelers.

On paper, the Chase Sapphire Reserve® benefits more than outweigh the annual cost of this card. Priority Pass Select membership can be worth $469 on its own, and cardholders get a $300 annual travel credit for airfare, hotel stays, and other travel bookings.

Other cardholder benefits like a fee credit for Global Entry, NEXUS, or TSA PreCheck membership, 50% more value for travel redemptions through Chase, and travel insurance coverages increase the card's value proposition. Additional benefits on the Chase Sapphire Reserve® come from brands like DoorDash, Lyft, and Peloton.

The one caveat, of course, is that these benefits only have worth if you'll actually use them, which is why the card is often recommended to frequent travelers.

Chase uses industry standard encryption practices to secure its website and mobile app, along with enhanced features like 24/7 fraud monitoring, multi-factor authentication, and biometric authentication. Cardholders enjoy $0 fraud liability protection on their accounts.

Chase boasts an intuitive and easy-to-use online interface and its mobile app has a 4.4 out of 5 rating on Google Play and 4.8 out of 5 stars in the App Store. Users can easily see their transaction history and pay their credit card bills online. The Chase Ultimate Rewards program is also known for its versatility, flexibility, and ease of use.

Chase is known for offering excellent customer service on the phone and via other contact methods, including secure messages. The card issuer makes it easy for customers to inquire about their card, its terms and conditions, or upgrading or downgrading to a different card product.

Chase scored slightly lower in this category due to reporting from the Better Business Bureau (BBB) on recent government actions due to its marketplace conduct.

Customers can reach out to Chase for help with their accounts 24 hours per day and seven days per week. Response times are typically fast, whether contact is established over the phone, via secure message, or through its social media platforms.

Chase's contacts include its credit card customer service number (1-800-432-3117) and its social media channels (tweet Chase at @ChaseSupport or message them on Facebook or Instagram.) Secure messages must be sent through a consumer's online account management page or mobile app account.

When we tested these channels:

If you asked a room of frequent travelers about their favorite premium travel credit card, there's a good chance many of them have the Chase Sapphire Reserve®. This popularity is partly due to the card's generous rewards rates and airport lounge benefits, but it's also due to the flexibility of the Chase Ultimate Rewards program.

Chase is known for having access to superior transfer partners compared to other flexible travel programs from American Express, Capital One, and Citi. This notoriety is mainly due to the brand's focus on partners that offer more travel redemptions within the U.S. In that respect, standout transfer partners from Chase include United MileagePlus, Southwest Rapid Rewards, and the World of Hyatt program.

These are just some reasons travel rewards experts like Jason Steele have the Chase Sapphire Reserve®. Steele says he loves the card's access to Sapphire and Priority Pass lounges and that he earns a minimum of 3X points on travel spending. He also likes redeeming points for 1.5 cents each toward travel booked through Chase, which can be a great way to redeem rewards and earn points (and credit towards elite status) from the airlines as well.

Finance expert and speaker Dr. Darla Bishop is another regular user of the Chase Sapphire Reserve®. Dr. Bishop says she loves the powerful earning structure on the card, plus the fact she can redeem points for any type of travel through the Chase portal.

"I also maximize the card’s additional perks," Bishop says. "The $300 annual travel credit automatically offsets travel purchases, which makes the effective annual fee much more manageable."

Bishop also says Priority Pass lounge access has been a "game-changer" for airport travel since it gives her a calm, comfortable space to relax during layovers.

"Other benefits like trip cancellation insurance, primary car rental insurance, and no foreign transaction fees make it a strong and reliable travel companion," she said.

Reddit users seem to agree that the Chase Sapphire Reserve® makes sense for consumers who travel regularly. In that case, they can justify the annual fee with the $300 annual travel credit, Priority Pass Select membership (retail value of $469), access to Chase Sapphire airport lounges, and the card's fee credit for Global Entry, NEXUS, or TSA PreCheck membership (up to $120 every four years).

For those who don't travel often, it could make sense to pick up a travel credit card with a lower annual fee and fewer benefits.

Expert intel: "For those who want similar benefits but find the annual fee too high, the Chase Sapphire Preferred® is a fantastic alternative. With a $95 annual fee, it still earns 2X points on travel and dining and comes with the same ability to transfer points to travel partners. It’s a strong option for casual travelers or anyone looking to earn Ultimate Rewards points without the upfront cost of the Sapphire Reserve." — Dr. Darla Bishop

In order to create this comprehensive guide and overview of the Chase Sapphire Reserve®, we looked at various factors that impact credit cardholders the most.

These factors include rewards earning rates and redemption options, rates and fees, features and benefits, account security features, user experience, and customer service.

To add more depth to our review, we considered first-hand experiences of current and past Chase Sapphire Reserve® customers. We also surveyed overall consumer sentiment on review platforms and message boards, including Reddit.

Learn more about how we rate and review credit cards and their issuers.

The Chase Sapphire Reserve® can be well worth the $550 annual fee if you travel enough to use the card's benefits. This exchange means having enough travel expenses to use the card's $300 annual travel credit each year and flying enough to take advantage of the included Priority Pass Select and Chase Sapphire airport lounge memberships.

You can redeem rewards for travel and non-travel options, which makes this card incredibly versatile. However, you'll get the most value if you redeem points for travel through Chase or transfer them to airline and hotel partners for premium travel redemptions.

If you can't see yourself traveling enough to justify paying a $550 annual fee, on the other hand, there are plenty of other top travel credit cards to consider.

What Is the Four-Year Rule for the Chase Sapphire Reserve®?

Chase limits card approvals for consumers who already have a Chase Sapphire card or have had one in the last four years. The fine print on this card outlines this rule very clearly:

"The product is not available to either (i) current cardmembers of any Sapphire credit card, or (ii) previous cardmembers of any Sapphire credit card who received a new cardmember bonus within the last 48 months."

What Is the Minimum Income for Chase Sapphire Reserve®?

Chase doesn't list minimum income requirements for its rewards credit cards. Instead, the issuer says applying for the card authorizes it to "obtain credit bureau reports, employment, and income information about you that we will use when considering your application for credit."

How Can You Upgrade From the Chase Sapphire Preferred® to the Chase Sapphire Reserve®?

You can call Chase using the number on the back of your card to inquire about upgrading or downgrading this or any other card product. Results aren't guaranteed, but you may be eligible if you meet their requirements and your account is in good standing.

Disclosure: Opinions expressed here are author's alone, not those of any bank, credit card issuer, airlines or hotel chain.