This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which may impact the location and order in which brands (and/or their products) are presented, and may also impact the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

Bank of America is the second-largest bank in the United States and is very much a traditional bank in many ways. This comes with advantages like its long standing reputation, physical branches, and extensive ATM availability. However, like most traditional banks, it has the disadvantage of high fees and low interest rates.

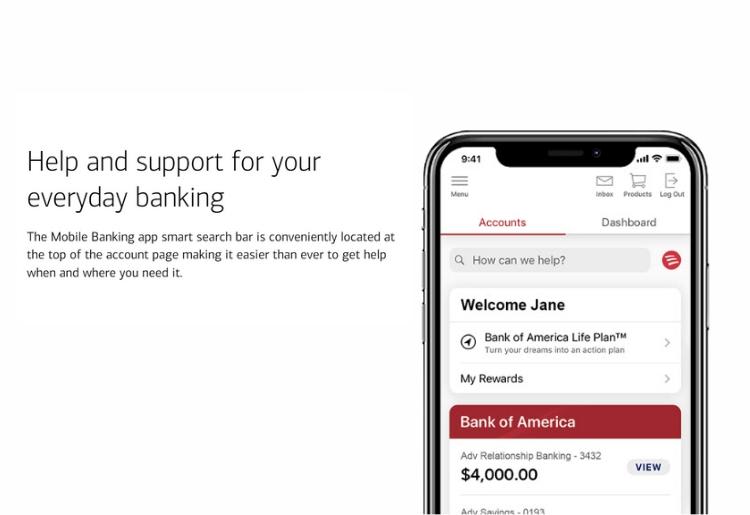

Despite being old-fashioned in many ways, Bank of America has nevertheless moved with the times by investing in digital banking and technology and keeping pace with the evolving financial landscape.

Bank of America Advantage® Banking also offers a $300 bonus offer.

See offer page for more details.

Bank of America’s online platform and mobile apps offer innovative services, which include the following:

Bank of America is a brick-and-mortar bank with thousands of ATMs and financial centers. Advantage Plus and Advantage Relationship accounts come with the option of paper checks.

Fund availability at Bank of America depends on several factors, including the type of deposit and how you make it. Cash deposits and electronic transfers are typically available for immediate use. Check deposits can vary, although Bank of America generally follows a standard availability schedule as mandated by federal regulations.

Compared to many other checking accounts, Bank of America’s monthly maintenance fees, overdraft charges, and minimum opening deposits are high. There’s also no interest paid on SafeBalance Banking® and Advantage Plus accounts. However, this is not unusual for standard checking accounts.

The Advantage Relationship account offers annual percentage yields (APYs) of between 0.01% and 0.02%, as of Wednesday, April 16th 2025.

| Bank of America Advantage SafeBalance Banking® | Bank of America Advantage Plus Banking® | Bank of America Advantage Relationship Banking® | |

| Best for | People who need help managing their finances | Anyone who needs a standard checking account with overdraft facilities | Wealthier customers who expect to have a balance of $20,000+ |

| Minimum opening deposit | $25 | $100 | $100 |

| Monthly maintenance fee | $4.95 (or $0 if you’re a student under 25 or enrolled in Preferred Rewards*) | $12 (or $0 if you have a qualifying direct deposit of $250+ or you maintain a $1,500 minimum daily balance, or you’re enrolled in Bank of America Preferred Rewards*) | $25 (or $0 if you maintain a combined balance of $10,000 or more, or you’re enrolled in Bank of America Preferred Rewards*) |

| Annual Percentage Yield (APY) | N/A | N/A | 0.01% for balances of less than $50,000 0.02% for balances of $50,000 and over |

| Overdraft facility? | No | Yes | Yes |

| Overdraft Fee | N/A | $10 | $10 |

Annual Percentage Yields (APYs) and account details are accurate as of Wednesday, April 16th 2025. See www.bankofamerica.com/depositrates for today's rates.

*Bank of America Preferred Rewards® is a reward scheme available to members with at least $20,000 across all accounts.

Bank of America’s customer support phone number is 800-432-1000. It’s available Monday- Friday, 8am-11pm (ET), and on weekends from 8am to 8pm (ET). There’s also a dedicated support line for Spanish speakers.

Bank of America also has customer support accounts on Facebook and Twitter. These operate Monday- Friday, 8am-9pm (ET), on Saturdays from 8am to 8pm (ET), and on Sundays from 8am to 5pm (ET).

In addition, the website has an extensive collection of FAQs, knowledge guides, videos, and guided demos, which are easy to find. Applying for an account is straightforward, and you can do it online.

There’s no online chat available on the website. However, once you’re a Bank of America customer, you can use Erica, a virtual banking assistant that’s part of the bank’s easy-to-use mobile app. Customer ratings for the app are high, with a score of 4.6 out of 5 on GooglePlay and 4.8 on the App Store.

Bank of America's award-winning mobile app is available for both iOS and Android devices and offers a range of features and functionalities to help you manage your accounts on the go.

Mobile App features include a digital wallet, mobile check deposit, bill payments, money transfers, available balance notifications, and security alerts. You can log into your account using Touch ID and Face ID.

All Advantage Banking accounts are FDIC-insured, which means that the Federal Deposit Insurance Corporation covers deposits up to $250,000 should the bank fail or experience financial difficulties.

The bank’s Consumer Online and Mobile Banking Guarantee ensures you won't be liable for any unauthorized transfers or bill payments. The Advantage SafeBalance account meets Bank On National Account Standards, which were set up to ensure that people have access to safe, low-cost bank accounts.

Bank of America employs SSL technology to encrypt data and protect sensitive information, such as login credentials and account details. It also offers biometric login and 2-factor authentication. There’s a dedicated fraud team to contact if you become aware of suspicious activity on your account.

Bank of America's Advantage Banking offers a range of features and options to suit different customers. Advantage SafeBalance Banking is a basic account with no overdraft facility that’s a good choice for anyone who needs help staying in the black.

Advantage Plus Banking offers a comprehensive selection of features, including overdraft facilities and paper checks. Advantage Relationship Banking, aimed at those with higher balances, offers everything that Advantage Plus Banking does, with added perks like regular interest payments.

Although its monthly fees and relatively high minimum deposits may be off putting to some, Bank of America offers the security that comes with being a longstanding traditional bank. What’s more, its mobile app is one of the best around, with an easy-to-use interface and a wide range of valuable features.

Information for this review was gathered from Bank of America’s website, including its schedule of fees and clarity statement. Trustpilot, App Store, and Google Play were also consulted.

The offer is for new checking customers only. Offer expires 5/31/2025. To qualify, open a new eligible Bank of America Advantage Banking account through the promotional page and set up and receive Qualifying Direct Deposits* totaling $2,000 or more into that new eligible account within 90 days of account opening. Bank of America Advantage SafeBalance Banking® for Family Banking accounts are not eligible for this offer. Once all requirements are met, Bank of America will attempt to pay bonus within 60 days. Additional terms and conditions apply. See offer page for more details

*Qualifying Direct Deposits are direct deposits of regular monthly income - such as your salary, pension or Social Security benefits, which are made by your employer or other payer - using account routing numbers that you provide them.