This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which may impact the location and order in which brands (and/or their products) are presented, and may also impact the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

Advantages Over Traditional Banks

The fees associated with the Discover CashBack Debit checking account are much lower than with many traditional banks. It has no monthly fee, no fee for insufficient funds, and the bank offers no-fee bank checks. There’s also no minimum balance or activity requirements for the account to have no fees.

Discover offers 1% cash back on debit purchases (See website for details), and the around-the-clock support provides the kind of convenience that many traditional banks cannot match with their limited hours. The collection of online tools and resources on offer also set Discover apart from traditional banks.

Cutting-Edge Banking Services

One of the most unique things about the account is that you can get the funds from your paycheck up to two days early when you set up direct deposit with the Early Pay feature.

You can also pay for purchases with a digital wallet like Apple Pay right from the app, and earn rewards while doing so. The Discover app is compatible with some types of wearable technology so you can easily check on your balance or account activity, right there on your wrist.

Discover lets you consolidate your bills into a hub that makes it easy to keep track. You can set up automatic payments to ensure your bills get taken care of on time. It's also possible to seamlessly and quickly transfer funds between accounts, even if one is not a Discover account.

What’s more, the bank provides free online privacy protection. Every 90 days, the bank will scan for your personal information on people-search sites and opt out on your behalf to keep your information private.

Traditional Banking Services

Despite having a single physical location in Delaware, Discover offers some traditional banking services as well. It provides fee-free access to 60,000+ ATMs across the country, and the bank offers mortgages, individual retirement accounts (IRAs), student loans, credit cards, and personal loans.

Interest Rates and Fees

The Discover Bank Cashback Debit checking account charges no fees whatsoever. Note that it also doesn’t offer any interest on the account, but Discover provides a variety of other accounts to consider for your banking needs. Interest rates and fees vary on a case-by-case basis.

| Fees | Interest (APY) | Minimum opening deposit required | |

| Checking | No fees | N/A | N/A |

| Savings | No fees | 3.60% | N/A |

| Certificate of Deposit (CD) | Early withdrawal penalty fee | 4.30%-4.70% depending on term length | $2,500 |

| Money market account | No fees | 3.50% for balances under $100,000, 3.55% for over | $2,500 |

| IRA CD | Early withdrawal penalty fee if you’re under 59.5 years old. | 4.10%-4.50% depending on term length | $2,500 |

| IRA Savings Account | No fees | 3.60% | N/A |

Customer Service and Online Experience

Discover offers 24/7 phone support, and you can also reach out on the mobile app, via social media, or through the mail. The company has multiple support numbers for everything from opening an account and technical support to reporting fraudulent activity. Reviews for Discover customer support are generally positive.

Its website has a comprehensive FAQs page, and using the app is clear and straightforward. It also has a Discover Modern Money blog. It features articles on helpful topics like how to build a budget, how to invest, how to teach your kids about saving, and more.

Mobile App

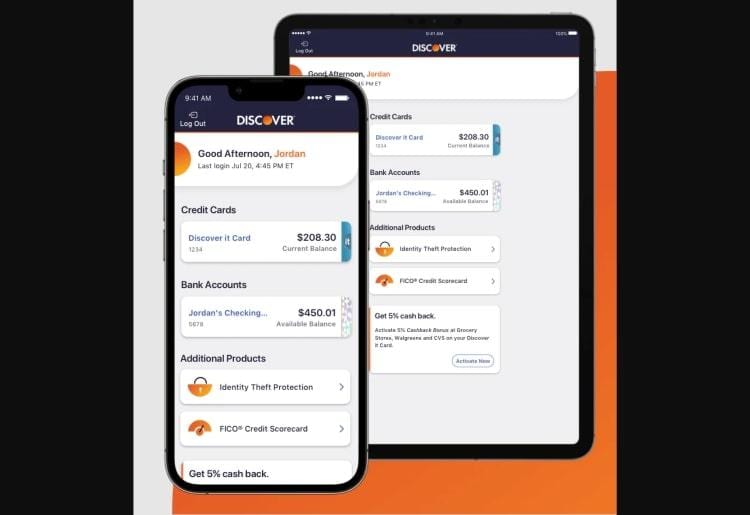

You can use the Discover App on iOS and Android devices. It gives you the ability to control and manage your bank accounts from anywhere, at any time. It supports mobile check deposits, provides an ATM finder, and lets you easily pay bills online.

You have the ability to set account alerts to monitor your account, and the app lets you reach out to customer support directly.

Logging into the app on your device is as easy as using a four-digit passcode or using Touch/Face ID to gain instant access. You can also use the Quick View feature to check your account balance without logging in.

Security

Discover takes your security seriously. It uses SSL encryption to protect your information, lets you set up two-factor authentication (2FA), and monitors all accounts for fraudulent activity. The account is FDIC-insured up to the legal maximum amount of $250,000, and you are never responsible for unauthorized debit purchases.

You can set up alerts to monitor your account, and freeze your card if something looks suspicious. Freezing will stop Discover from authorizing debit purchases or ATM withdrawals with the card, but other account activity will continue as normal. Discover also has a team of dedicated fraud specialists.

The bank limits the sharing of information and has physical, electronic, and procedural safeguards in place to protect sensitive data. It also provides helpful tips and guidance about what you can do to maintain your personal security, such as watching out for scams, protecting your login information, and creating a strong password.

Discover’s privacy center provides clarity on what information the bank collects, how it uses and shares it, and what efforts it takes to protect it.

Summary

The Discover Cashback Debit checking account charges no fees and gives you 1% cash back on purchases. (See website for details.) You can access it anywhere using the Discover App, and it gives you access to 60,000+ fee-free ATMs across the country. The account is secure and Discover offers resources to educate you on a variety of financial topics.

Methodology

The information was taken from the Discover website, as well as its security center and privacy policy to write this review.