This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which may impact the location and order in which brands (and/or their products) are presented, and may also impact the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

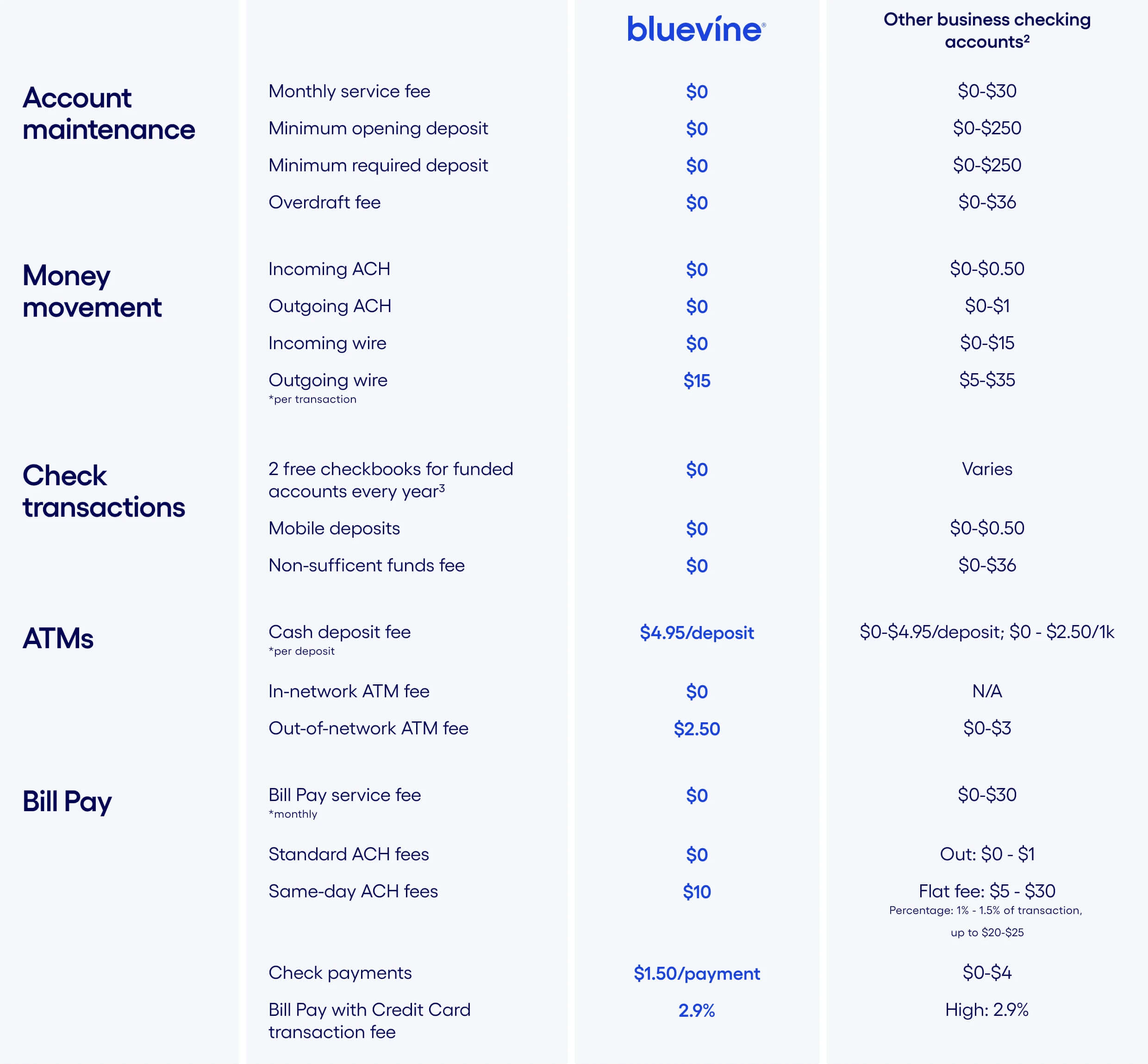

Bluevine shows an above average performance when it comes to affordability and ease of use. With the national average interest yield sitting at 0.06%, Bluevine offers their checking account interest at a competitive rate of 1.50% for eligible customers on balances up to and including $250,000. In addition to their interest rate, Bluevine also offers no monthly fees, free standard ACH and incoming wire transfers, $10 same-day ACH, and built-in bill pay solutions that save you time. This positions Bluevine among the best online banks for small businesses looking for a reliable financial partner.

Customers are given complete control of their finances with Bluevine. You can access your accounts through their online portal or mobile app to transfer funds and upload checks from anywhere at any time. FDIC insurance on Business Checking balances up to $3M through Coastal Community Bank, Member FDIC, and their program banks.

Bluevine also allows you to send international payments to 32 countries in 15 currencies with a simple, transparent fee structure:

Currency | Fee |

Sending USD to an international payee | $25 |

Sending a foreign currency to an international payee | $25 + an additional 1.5% of the payment amount in USD |

Bluevine Business Checking comes with a robust bill pay platform that's built to save you time while you grow your business. Streamline your bill pay by using payment options you're familiar with (like ACH, wire, or check), or pay most bills by credit card. Set up permissions so your team or accountant can submit bills for your approval, and make or schedule multiple payments at once. Easily sync with your QuickBooks Online account and protect your cash with automatic fraud prevention for check payments.

Bluevine offers several ways for their customers to reach them. Support can be reached by phone on Monday - Friday from 8:00am-8:00pm (EST). Alternatively, customers can find support through email by filling out the online form available through their website or by email.

Bluevine’s mobile banking app allows you all the control of your business finances from the convenience of your smart device. The app allows you to view your balances, manage cash flow, track transactions and deposit checks without ever having to set foot in a bank.

Online banking offers the simplest form of convenience but with that comes the need for additional safety precautions. This has made security for customers a top priority, Bluevine understands this concept and takes every measure to protect its customers from fraud and identity theft. Business Checking balances are FDIC insured up to $3M through Coastal Community Bank, Member FDIC and their program banks. In addition, Bluevine has implemented a comprehensive security system with safeguard procedures including SSL encryption to ensure every customer's information is kept confidential.

Bluevine’s online banking option is a safe and affordable platform for small businesses looking to grow their company, receive low interest funds and conveniently manage bills. With no monthly fees, thousands of free in-network ATMs, international payment options, and full banking services offered, online banking with Bluevine is simple and affordable.

¹ No limit on numbers of transactions, However, all accounts are subject to the aggregated monthly deposit and withdrawal amount limits of the Account Agreement.

² To earn the $300 bonus, customers must apply for a Bluevine Business Checking account

anytime between now and 12/31/2024 using the referral code above. After opening the account, customers must add funds within 30 days, then meet at least one of the following

eligibility requirements every 30 days for the next 90 days from account funding:

• Deposit at least $5,000 from eligible merchant services to your Bluevine account

• Make at least $5,000 of outbound payroll payments from your Bluevine account using eligible payroll providers

• Spend at least $2,000 with your Bluevine Business Debit Mastercard® and/or Bluevine Business Cashback Mastercard®

² Payments are sent out from 8am-5pm ET every business day. Timing may vary based on recipient bank and country, and whether payment is sent during business hours. The only eligible funding method for international payments is Bluevine Business Checking accounts. International payments are available to most businesses, subject to eligibility determined by Bluevine. Exceptions include businesses based in Nevada or in the categories of finance, insurance, or mining.

³ Bluevine accounts are FDIC insured up to $3,000,000 per depositor through Coastal Community Bank, Member FDIC and their program banks. $3,000,000 in FDIC insurance is offered by multiplying the standard $250,000 FDIC coverage across multiple banks. For complete details, please visit https://bluevine.com/business-checking/fdic-protection.