This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which may impact the location and order in which brands (and/or their products) are presented, and may also impact the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

This content is not provided by Citibank. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone and have not been endorsed by Citibank.

Citibank business checking accounts offer high monthly transaction limits to suit the needs of your business. The Streamlined checking account offers 250 monthly transactions and up to $10,000 per month in cash deposits, while the Flexible checking account offers 500 monthly transactions and up to $20,000 per month in cash deposits.

You can open a Citibank business checking account with as little as $1. In addition, the fees for the Streamlined and Flexible accounts are waived when you have a balance of at least $5,000 or $10,000, respectively. The Streamlined account costs $15 per month. The Flexible account costs $22, $25, or $30 per month depending on your location.

Citibank also offers an Interest checking account, which earns interest on your cash. Interest rates and monthly account fees vary by location, but the monthly fee is waived if you have at least $10,000 in your account. The Interest account costs $22, $25, or $30 per month depending on your location.

Citibank is currently offering new customers up to $2,000 when you open an Analyzed Streamlined or Flexible business checking account. To qualify for the offer, you must be a new Citibank Retail Business Banking customer and make a deposit of at least $5,000 within 30 days of opening your account. You must maintain the balance for 60 days to earn the bonus. These features position Citibank among the best online banking companies for businesses.

All Citibank business checking accounts include access to online banking, bill pay, and account alerts. Citi also has a mobile app to enable deposits and transfers on the go.

One of the unique aspects of Citibank business checking accounts is that they integrate with Citibank’s Checking Plus program, a revolving business line of credit. You can use this line of credit to automatically pay overdrafts or bills.

Citibank has more than 700 physical branches throughout the US and more than 60,000 fee-free ATMs. The bank offers a wide range of traditional services including credit cards, personal checking and savings accounts, CDs, mortgages, and a self-directed investing platform. Citibank also offers small business loans.

For a limited time, Citibank is offering new business checking customers up to $2,000 when you make a qualifying deposit of $5,000 to $200,000 within 30 days of opening an account.

Citibank offers 24/7 customer support by phone, email, and live chat. You can access live chat online or through the Citibank mobile app. The customer service agents are helpful but not always very knowledgeable, and you may be on hold for a long time if you contact the support team by phone. You can also get help by visiting any Citibank branch.

The Citibank website has a detailed online knowledge base. The knowledge base is well-organized and searchable, making it easy to find the information you need.

Importantly, you cannot sign up for a new Citibank business checking account online. You must call or visit a branch to set up a new account.

https://www.youtube.com/watch?v=YMddKCiSqjk

Citibank offers a free mobile app for iOS and Android. It enables you to view your transactions, transfer money, and deposit checks to your business checking account. You can also use the app to manage your online bill pay or to access your revolving line of credit if you have one.

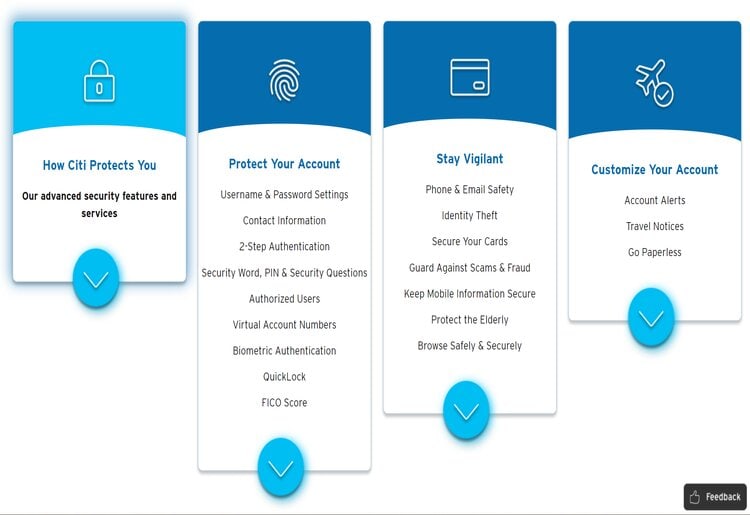

Citi uses 2-factor authentication, biometric authentication, and 128-bit SSL encryption to protect customer accounts. You can instantly lock your account from your online dashboard or the Citibank mobile app. In addition, you are not liable for any unauthorized transactions made using your business checking debit card.

Citibank offers business checking accounts with features like up to 500 monthly transactions, $20,000 in monthly cash deposits, online bill pay, and a potential revolving line of credit. New customers can earn up to $2,000 with a $5,000 deposit.

With over 700 branches and 60,000 ATMs nationwide, Citibank provides convenient access to your funds. Manage your account on the go with their free mobile app. To open a business checking account, visit a Citibank branch or contact customer support.

Any opinions, analyses, reviews, or recommendations expressed in this review are those of the author’s alone and have not been endorsed by Citibank.