This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which may impact the location and order in which brands (and/or their products) are presented, and may also impact the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

For many freelancers and self-employed people, Found’s most significant advantage over more traditional banking services is likely to be its lack of required monthly fees, as many of its competitors impose hefty monthly maintenance or account management charges on their small business accounts. Found has no monthly fee unless you opt to upgrade to Found+, a newly launched paid subscription account, for more benefits.

If you’re concerned about your financial history, you may be reassured to learn that the company won’t run a credit check when you open an account.

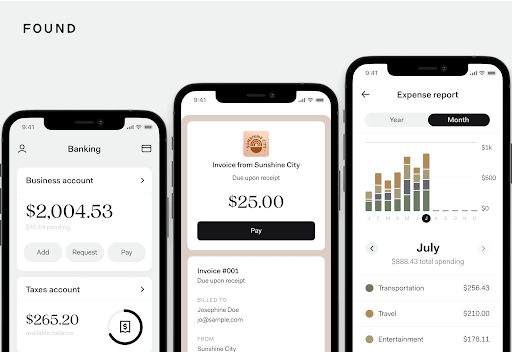

Several of Found’s most innovative features relate to its tax and invoicing services, rather than business banking.

One interesting feature is the company’s receipt capture tool, which can help ensure you aren’t caught out by lost receipts during tax season. Its automatic expense categorization feature can also dramatically reduce the amount of time you spend getting your accounts in order. You can, for instance, create customized expense categories relevant to your business in areas such as travel costs and office supplies.

The company’s array of tax-specific tools is impressive. In addition to the option of paying your taxes directly from the app as a Schedule C filer, you can also see an estimate of your tax bill in real time before it’s due which can help you avoid the nasty surprise of a higher-than-expected charge. Furthermore, Found will automatically generate your Schedule C form if you’re self-employed.

You can also customize your invoices with your business’s branding, which can help create a professional image when communicating with your clients. In addition to this, you can select a payment method for receiving funds. Although this includes credit cards, direct deposits, and payment services such as Zelle, you can’t accept cash payments.

When you sign up for an account, you’ll receive a free Mastercard debit card. To help you stay on top of your account balance, Found will send instant notifications of purchases made with your card. You can also use the card to withdraw funds at any ATM that accepts Mastercard.

As you would expect from a traditional banking service, your account will include account and routing numbers.

One of the most attractive aspects of Found is that there are no required monthly fees. However, you may have to pay a fee to withdraw cash at an ATM using your Found Mastercard. These fees are not set by Found or Mastercard, and are determined by the company that owns the ATM.

You can contact Found over phone, email, or through its online query form. They offer customer service 7am-5 pm on weekdays and 9 am to 5 pm on weekends.

There is also a detailed selection of FAQs on the company’s website, which provides a lot of helpful information about its services.

You can sign up for an account in as little as five minutes. After entering your email address into the company’s online tool, you'll receive an authorization code. This will allow you to continue with your application by providing further financial details such as your tax ID.

Found’s mobile app is available to download from the App Store and Google Play. It allows you to:

With security being a top concern for small business owners, entrepreneurs can rest assured by the robustness of Found’s security features.

In addition to a dedicated fraud team, Found 24/7 monitoring service will immediately alert you to any suspicious activity on your account.

All databases are safeguarded via AES-256 encryption, which provides the highest level of protection currently available. Found also operates with a two-factor authentication system by sending verification codes to mobile phones.

Found also has a detailed privacy policy on its website.

If you're self-employed and want to save time when organizing your business banking, Found is a great way to streamline all your financial management into one place. While the company doesn't have any physical branches, Found offers many benefits in its impressive selection of tax and bookkeeping tools, and provides comprehensive online guidance that could prove invaluable if you run your own business. Found's banking services are provided by Piermont Bank, member FDIC. Funds are FDIC insured up to the limit of $250,000 per depositor for each account ownership category.

We compiled this review by visiting Found’s website, contacting its customer service team over email, and reading other online reviews of its service.

*Found is a financial technology company, not a bank. Banking services are provided by Piermont Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category The Found Mastercard ®️ debit card is issued by Piermont Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted. Advanced, optional add-on bookkeeping software available with a Found Plus subscription for $19.99/ month and $149.99/ year. There are no monthly account maintenance fees, but transactional fees for wires, instant transfers, and ATM apply. Read more here.