This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which may impact the location and order in which brands (and/or their products) are presented, and may also impact the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

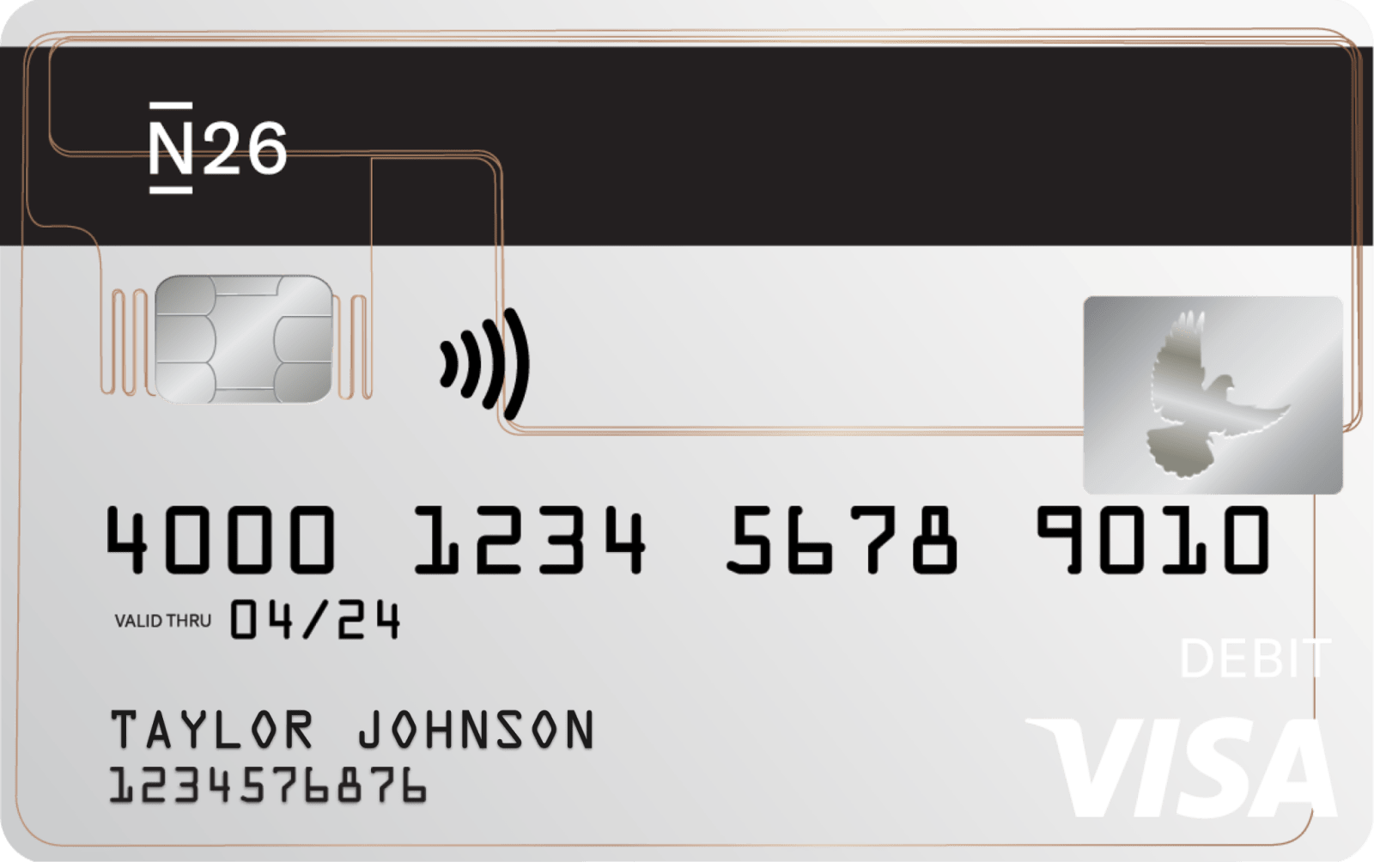

As an app-based solution, N26 takes a data-driven approach to personal finance, with its analytics tools offering a robust overview of your spending. Not having bricks-and-mortar branches also allows the bank to save on overheads, which is reflected in its low fees.

Some of N26’s advantages over traditional banks include:

N26’s model is designed for tech-savvy customers seeking an account that gives them the freedom to manage every aspect of their finances in one place.

If you choose N26, you can:

Despite its focus on digital banking, N26 offers a number of the more useful features and rewards of traditional banks, including:

While the account has a low-fee policy, you may incur the following charges:

| Fee type | Fee amount |

|---|---|

| Monthly service | $0 |

| Monthly minimum balance | $0 |

| Domestic ATM |

|

| International ATM | $2, plus 2% of withdrawal amount after conversion to US dollars |

| Foreign transaction | $0 |

| Card replacement |

|

| Insufficient funds | $0 |

| Processing (e.g., orders of garnishment and tax levy) | $100 |

If you have a question or concern about your account, you can contact N26 over the phone, via email or social media, or through the app. Its customer support hours are 9 am-11.59 pm EST Monday to Friday, and 9 am-9 pm EST on Saturday and Sunday, minus the recognized holidays.

As you might expect from a 100% mobile solution, you can access every aspect of the bank’s services via its app, which is available from the Apple App Store or Google Play Store.

Watch this video to learn more about N26’s mobile banking app.

If you’re concerned about security, N26 offers a range of features to protect you and your money against cybercrime, which includes:

If you prefer the convenience of managing your day-to-day finances through an app, N26 has a great deal to offer. As well as giving you the freedom to manage your money on the go, the bank’s analytics tools provide you with a comprehensive picture of all your spending. While the bank doesn’t pay interest on deposits, this is not unusual for low-fee checking accounts and, in most cases, should not detract from the benefits of using N26.

This review was compiled using information on the company’s website and social media sites, as well as contacting its customer support staff.